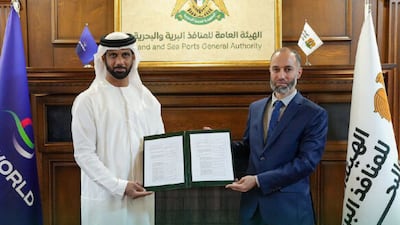

The Syrian government and DP World, the Dubai-based global ports operator, have signed an initial agreement worth $800 million to develop Syria's port of Tartus.

The agreement is aimed at strengthening port infrastructure and logistics services in the country transitioning after more than a decade of civil war, Syrian state news agency Sana reported on Friday.

It is among the first deals Damascus has announced after US President Donald Trump this week said America will lift sanctions against Syria.

The initial agreement includes a “comprehensive investment in the development, management, and operation of a multipurpose terminal at Tartus Port”, according to the Sana report.

When finished, the project will contribute to raising the port's efficiency, increasing its operational capacity, and will enhance its role as a hub for regional and international trade.

The two sides have also agreed to co-operate in establishing industrial zones and free zones, in addition to dry ports and freight transit stations in strategic areas in Syria.

The agreement “reflects both parties' commitment to supporting economic development and facilitating trade and transport”, the report added.

DP World confirmed the agreement in a statement later on Friday, saying it is “committed to responsible investment to make trade flow around the world … aligned with the evolving regulatory framework in the light of recent positive developments and signals of renewed international engagement with Syria”.

In March, Sultan bin Sulayem, DP World's group chairman and chief executive, said that the company plans to expand into new locations as part of its long-term strategy and maintains a “positive medium-term outlook.”

Its revenue for 2024 grew 9.7 per cent to a record $20 billion on improved ports and terminals performance as well as contributions from new acquisitions and concessions. However, profit for the year was down 2 per cent at $1.5 billion due to higher finance costs.

In January, DP World said it was considering additional investments in its port operations in Peru, after expanding the Port of Callao in the Andean country last year.

With port operations spanning from Canada to Australia, DP World has passed 100 million twenty-foot equivalent units (TEUs) of container-handling capacity across its global operations, it said earlier this year. Its global gross container handling capacity increased by 5 per cent in 2024.

“Despite global uncertainties, DP World is well-positioned for long-term growth, leveraging its integrated supply chain solutions and strategic investments,” it said in March.

US sanctions

Earlier this week, before his milestone meeting with Syrian leader Ahmad Al Shara in the Saudi capital, Mr Trump announced he would move to lift sanctions against Syria.

The removal of sanctions will pave the way for foreign investment to flow into the war-devastated country.

The civil war in Syria began after the suppression of a peaceful protest movement calling for the removal of Bashar Al Assad, president at the time in 2011.

That conflict, and subsequent fighting against opportunistic extremist groups such as ISIS, resulted in the devastation of infrastructure, displacement of skilled labour and the draining of domestic industry.

The Assad government was overthrown in December 2024 by militant groups led by Mr Al Shara.

Years of conflict took a toll on Syria's economy, with the UN Development Programme estimating cumulative losses – including physical damage and economic deprivation – at more than $923 billion by the end of last year.

Estimates of the cost of reconstruction, meanwhile, have ranged between $250 billion and $500 billion.