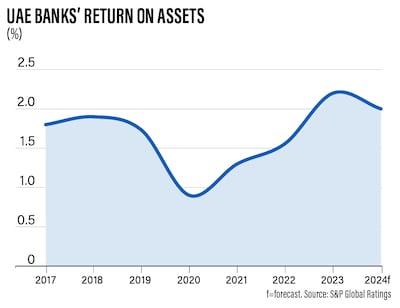

Banks in the UAE are well placed to continue posting strong earnings this year, capitalising on an improving macroeconomic environment and consistently high interest-rate regime supporting their profit margins, S&P Global Ratings has said.

The increased business and trading activity that supported non-interest income and bottom-line growth last year will also boost profitability in 2024, the ratings agency said in its latest report on the UAE banking sector.

The trajectory of earnings growth for lenders in the Arab world’s second-largest economy, however, will be slightly lower than that of 2023 as a result of expected interest rates cuts towards the end of this year.

“This is assuming a 100 bps (basis points) rate cut by the US Federal Reserve during the second half of the year. In accordance with the UAE dirham's peg to the US dollar, we expect the Central Bank of the UAE to mirror the Fed's movements,” S&P credit analyst Puneet Tuli said.

However, despite the expected cuts this year, interest rates will remain at elevated levels and will continue to support profit margins of financial institutions in the UAE.

“We believe interest rates will remain higher for longer, and this will support banks' net margins,” S&P said.

“Coupled with a broadly stable cost of risk, the profitability of UAE banks is likely to remain strong, albeit lower than last year.”

Most lenders in the UAE posted record earnings in 2023, driven by core banking activities, and have also benefited from higher interest rates that boosted profit margins over the past few quarters. Most regional central banks peg their currencies to the US dollar and follow the Fed’s moves on interest-rate increases.

Earlier this month, the US central bank held interest rates steady at the current range of 5.25 per cent and 5.5 per cent. Fed chairman Jerome Powell squashed hopes of an early US interest-rate cut, saying the central bank needed “greater confidence” in the inflation path before it begins dialling back its restrictive monetary policy.

Banks in the UAE and the six-member GCC are also benefiting from the continued growth momentum despite global headwinds and geopolitical uncertainties. Economies in the broader Middle East and North Africa, especially oil-exporting Gulf countries in the GCC, have bounced back strongly from the pandemic-induced slowdown, driven by oil and non-oil sectors.

The UAE economy expanded 3.7 per cent annually in the first half of last year, driven by strong non-oil sector growth as the country continues to pursue its diversification goals, Minister of Economy Abdulla bin Touq said in October.

Last month, the UAE Central Bank increased its 2024 growth forecast for the country's economy to 5.7 per cent, from its earlier estimate of 4.3 per cent, due to an expected increase in oil production next year.

The banking regulator also raised the UAE's non-oil gross domestic product growth to 5.9 per cent and 4.7 per cent, for 2023 and 2024, respectively.

S&P Global Ratings expects an increase in oil production, and supportive non-oil sector growth in the UAE this year to boost real GDP to 5.3 per cent in 2024.

While the quicker pace of economic growth this year bodes well for lenders in the country, risks including geopolitical tensions may cause problems. A higher-for-longer interest rate regime could also crimp loan growth this year, as demand for new credit wanes because of high borrowing costs.

“Although the Israel-Hamas war and Red Sea conflicts currently pose a limited downside, a sharp escalation involving direct conflict between key actors could change the picture,” Mr Tuli said.

“UAE banks with exposure to Egypt face potential risks, but our base-case scenario does not foresee any shock that the banks could not absorb.”

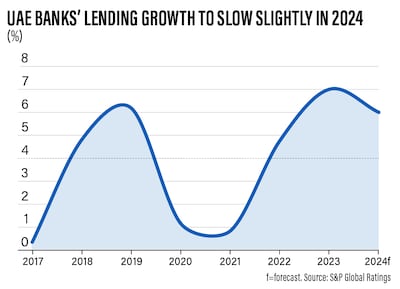

S&P expects UAE banks to report slightly lower credit growth than the 7 per cent reported last year.

“New lending eased in the last quarter of 2023, and we expect this trend will continue in the first half of 2024 as borrowing costs remain high and growth in non-oil sectors slows,” Mr Tuli said.

“[however,] we expect retail borrowing to remain strong as banks continue expanding in this profitable segment.”

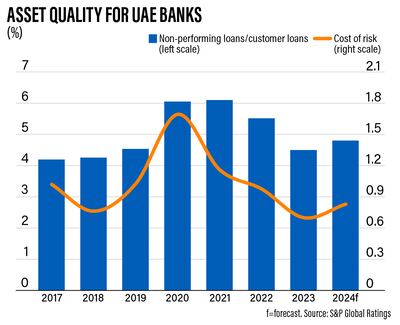

S&P also expects lenders’ asset quality to remain “broadly stable”, with only a slight increase in nonperforming loans and credit losses in 2024.