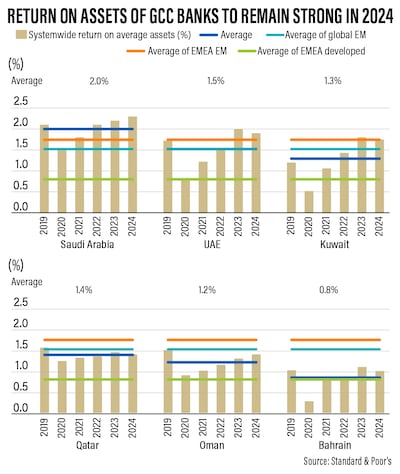

Profitability and credit growth will remain strong for most banks in the Gulf Co-operation Council this year, supported by robust credit demand from the non-oil sector and economic diversification programmes across the region, a report has said.

The UAE and Saudi banking systems are poised to continue their growth above the rest of the region, S&P Global Ratings said in its GCC Banking Sector Outlook 2024 report.

Overall, the credit rating agency expects banks across the GCC to deliver strong return on assets supported by the robust macroeconomic environment.

“Non-oil growth should remain particularly dynamic in Saudi Arabia and the UAE,” said Benjamin Young, an analyst at S&P.

“The economic environment will support credit demand and credit growth … This will support their profitability.”

Banks in the six-member bloc are benefitting from continued economic growth momentum despite global headwinds and geopolitical uncertainties.

S&P expects interest rates in the GCC to remain high but fall by 1 per cent by the end of the year, in step with the US Federal Reserve, as inflation is projected to remain on target and contained by price administration measures.

Economies of oil-exporting Gulf nations have bounced back strongly from the pandemic-induced slowdown, driven by both oil and non-oil sectors.

The UAE, the Arab world’s second-largest economy, expanded 3.7 per cent annually in the first half of last year, driven by strong non-oil sector growth as the country continues to pursue its diversification goals, Minister of Economy Abdulla bin Touq said in October.

Last month, the UAE Central Bank increased its 2024 growth forecast for the country's economy to 5.7 per cent, from its earlier estimate of 4.3 per cent, due to an expected rise in oil production next year.

The banking regulator also raised the Emirates' non-oil gross domestic product growth to 5.9 per cent and 4.7 per cent, for 2023 and 2024, respectively.

Saudi Arabia's economy, which expanded 8.7 per cent in 2022, the highest annual growth rate among the world's 20 biggest economies, was forecast to grow 0.8 per cent last year, according to the International Monetary Fund.

The World Bank has estimated GDP growth of 4.1 per cent this year for the Arab world's largest economy.

In its latest regional economic outlook, the IMF revised down overall growth forecast for the GCC to 0.5 per cent in 2023, 1 percentage point lower than its October estimate, but the economy of the bloc is expected to rebound to 2.7 per cent in 2024.

Structural reforms by GCC members are supporting economic diversification while increased domestic demand and capital inflows are also contributing to growth, the IMF said.

Broadly, the region’s credit growth is linked to public expenditure cycles, which are typically supported by hydrocarbon revenue and private sector activity influenced by sentiment related to the oil price outlook, S&P said.

“For credit growth, this means that although a base-effect compounded by higher-for-longer rates, increasing risk aversion, and uncertain external economic activity will weaken demand and increase lending caution, we still expect healthy lending for the year,” it said.

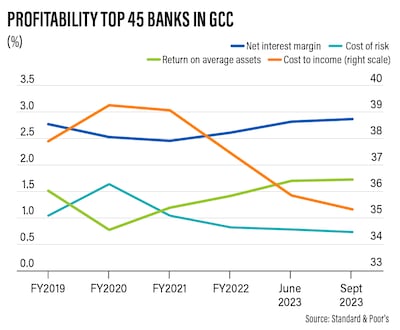

While the profit margins are forecast to remain strong for most GCC banks, S&P anticipates a slight softening from 2023 levels.

“Margins will likely start to narrow by the end of the year, reflecting a lagged impact of anticipated interest rate and higher funding costs,” Mr Young said.

The rating agency expects the real GDP growth of GCC countries to accelerate in 2024, except Bahrain, driven by stable oil prices.

“Notwithstanding volatile supply-demand dynamics, we expect oil prices to remain broadly stable over 2024, which, we believe, will support continued fiscal expenditure,” it said.

S&P expects the asset quality of GCC banks to remain strong this year, given the high levels of precautionary provisioning.

The banks' strong capitalisation levels are expected to support their creditworthiness and rating strength, according to the rating agency.

S&P said it sees further strengthening of capitalisation levels in 2024 on a risk-adjusted basis as most banks in the region are well capitalised and with high levels of profitability, internal capital generation is expected to boost ratios for many banks.

“We expect regional [ratings] strengths to remain, on average, close to ‘A-’, compared with a global average in the ‘BBB’ category,” it said.

Meanwhile, on key rating matrices such as funding and liquidity, GCC banks score high, according to S&P.

The region’s banks are predominantly funded by strong and stable domestic deposits and display strong net external positions, with the exception of Qatar where high rates of domestic (credit) growth have outpaced deposit funding, it said.

In Saudi Arabia, too, the rating agency expects a rising loan-to-deposit ratio eventually leading to higher external funding.

“We typically view external funding as less stable but continue to think GCC banks are well protected from external outflows,” it said.

Despite the strong operating environment supporting both profitability and credit ratings, S&P said “the complex and worsening geopolitical environment is a key risk for GCC banks”.

“The geography of the Israel-Hamas conflict is widening and proxy conflicts, which have previously directly involved GCC states, pose a potential route for further escalation. These could impair sentiment, investment, and capital flows, but we do not expect an event that would test financial stability,” the report said.

Additionally, S&P expects that some of the banking systems in the region could face a heightened risk of asset quality deterioration from a correction in the real estate sector.

“Real estate exposure is conspicuous in many banks’ Stage 2 and 3 loans. However, the sector endured substantial strain through the pandemic,” the report said.