Emirates, the world's largest long-haul airline, expects to return to 100 per cent of operations and network capacity in 2023 as demand for travel and tourism recovers.

The airline is in “good shape” in terms of moving to the next stage of recovery, it said.

Next year will be a “milestone” in terms of getting back to the level of operations where the airline had left it before the coronavirus pandemic, Emirates' chief operating officer Adnan Kazim told a media briefing on Tuesday.

The carrier is operating at 70 per cent of its pre-pandemic capacity and that will increase to 80 per cent before the end of the summer, he said.

Emirates expects its capacity to rise to 85 per cent by the beginning of its winter schedule in November.

“The focus remains on recovering the Emirates’ network and capacity, which will be the core,” Mr Kazim said. “For us, next year will be the year of full recovery — 100 per cent. That’s what we aim for.”

The Dubai-based airline posted a loss of Dh20.3 billion ($5.5bn) in the 2020-2021 fiscal year after the pandemic hit the aviation industry.

Most carriers received bailouts or a capital injection to cope with the worst crisis in the sector's history. Emirates received an injection of $3.1bn from the Dubai government.

Airport services provider Dnata received $218 million in relief from authorities during that fiscal year.

However, the demand for travel has bounced back strongly and the momentum has carried into this year. Emirates will record a “good set of results” for its fiscal year ended March 31, narrowing losses for the last 12 months.

The airline expects to return to profit in the next fiscal year, president Tim Clark said last month.

Emirates reported signs of recovery both in terms of seat factor and demand, Mr Kazim said.

“It’s very positive and that’s happening in all the sectors of the business that we are in today,” he said.

_____________________

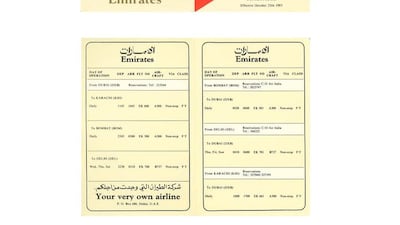

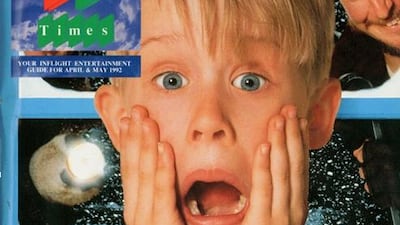

Emirates airline through the years - in pictures

_____________________

Emirates serves about 130 destinations, more than 90 per cent of its network, which will expand to 100 per cent of its pre-pandemic level in 2023.

The airline has almost 140 Boeing 777 aircraft in operation and 70 Airbus A380s superjumbos — a number which Mr Kazim expects to “ramp up before the end of the financial year”.

It is in talks with plane builders Boeing and Airbus for delays to deliveries of Boeing 787 and 777X jets as well as the Airbus A350 aircraft it has on order.

Emirates is spending about $1.3bn on retrofitting the 120 jets from its fleet of Boeing 777 ER and Airbus A380 aircraft as it now plans to keep some planes longer than planned.

“We have 67 of A380s and the remaining are [Boeing] 777s,” Mr Kazim said.

The airline’s cargo business is also holding up well despite geopolitical headwinds and more coronavirus outbreaks in China.

“We haven’t seen any difference in that [demand]. Still, the number is solid, still revenue for cargo [is] standing, as we have seen during the peak time last year and the year before that,” Mr Kazim said.

The airline is optimistic about growth prospects, helped by a pickup in the Dubai’s travel and tourism sector.

Emirates is working closely with the Dubai Corporation for Tourism & Commerce Marketing to improve growth in the sector.

Dubai, the tourism and commercial hub of the Middle East, was among the first destinations to open up for tourists in 2020 and stayed open with robust safety measures, which gave “confidence to global travelling population in the destination”, Issam Kazim, chief executive of DTCM, said while announcing the details of the Arabian Travel Market, which will be held in Dubai next month.

Dubai has concluded a successful Expo 2020 with 24 million visitors in six months, demonstrating the resilience of the emirate as a tourism centre, he said.

“It was successful event in its own right let alone it is coming on the back of a global pandemic,” Mr Kazim said.

The emirate had 7.3 million international visitors last year, and the authorities aim to surpass that number this year.

Dubai has started with 2.2 million visitors in the first two months of 2022, “showing that the energy is coming back”, he said.

DTCM is working on some key markets that still have not opened or have not “come back to their full scale”, he said.