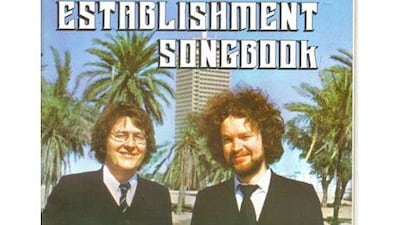

The long, long tails of two early UAE jams once lost to time. One sunny day in 1979, Patrick Brady and Michael Kiely were sitting in the Dubai Hilton's piano bar when they decided to write a song about the UAE. Brady and Kiely had been in town for four weeks; their folk duo, The Establishment, was on a three-month contract at the Hilton after a talent scout for Gulf hotels had caught their act in a Dublin bar. "We were bouncing around a lot of phrases that we had heard expats using - like 'expats'," Brady recalls. "I didn't even know that word then. Two months before, I'd never heard of Dubai. Then we got a little tourist book and looked at the seven emirates and juggled them around a little into a form that would scan."

Kiely sat at the piano, Brady grabbed a guitar, and soon enough Life in the Emirates was born. "It's tough in the Gulf when the AC's not working / And the desert is burning in the hot noonday sun," the song begins, kicking off a laundry list of expat concerns: trying to save money, missing family left at home, making new friends. Then there's the chorus: "Hala wa marhaba to life in the Emirates / Dubai, Ras al Khaimah, Abu Dhabi, Ajman / They're the places I love and the places I won't forget / Sharjah, Fujairah and Umm al Qaiwain." With the stress on the Umm, it comes out like this: OOM al Qaiwain!

"The Indian waiters were all loving it," Brady says. "So we decided to play it that night, and the crowd loved it. They loved that it mentioned all the emirates. If you're in Ras al Khaimah, it's good to know that Ras al Khaimah is in a song." A few weeks later, Brady and Kiely went into a studio in Sharjah to record the song: a folksy arrangement featuring acoustic guitar, pan pipes, some light bongos and an instrument Brady bought in an Indian market in Abu Dhabi, didn't learn the name of, and has never seen again since. There were no record pressing facilities in the UAE back then, so they gave the tape to a Lufthansa pilot staying at the Hilton, who carried it back to Dublin in his shirt pocket. A few weeks later, cardboard boxes filled with 1,000 Life in the Emirates singles arrived at the Hilton; they sold out within days, and the song was soon being spun several times a day on local radio. The band was invited to Sheikh Rashid's majlis. When the Hilton gig was up, the Establishment was able to parlay their new fame into bookings across the UAE and the Gulf. The duo toured the region for four years before splitting up: Kiely went back to Ireland to raise a family; Brady moved to Australia but continued working as a musician.

Today he still works lots of cruise ships and hotels; every few years he ends up back in the Emirates (he last played Abu Dhabi two years ago), and every time he gets requests for his old hit. "I'm happy to play it," he says. "The days in the Emirates were the happiest days of my life." Today, Life in the Emirates is enjoying a strange second life of a kind perhaps unique to the internet age. In 2005, Secret Dubai Diary, a blog about the UAE, riffed on the news that scientists were compiling a CD of the singing-like sounds sand dunes emit during avalanches. "What melodies will the dunes of Dubai be singing?" the post wondered. Much punning ensued: Bridge Over Troubled Wadi, I Want to Hold Your Sand, and so on.

"Speaking of sand dunes," one poster asked, "does anyone remember a real gem of a song from days gone yonder titled Back in Dubai?" "Is this the same one," suggested another commenter, that goes something like: 'The life in the Emirates, Dubai, Abu Dhabi ...' and went on to list the rest of the emirates?" It wasn't, but it took commencers a while to sort out the confusion. By November, 2007, it was finally clear that Dubai's nostalgic blog-readers were on the trail of two separate songs: The Establishment's Life in the Emirates and Back in Dubai, a disco-rock track by the genre-hopping Kenyan singer Sal Davis (real name: Salim Abdullah). Like Brady, Davis performed frequently in hotels throughout the Gulf in the 1970s and Eighties. For a while, he even hosted a musical variety show on Dubai's Channel 33 TV. Back in Dubai was used as the backing track for one of the first inflight promotional films shown on Emirates Airline flights. "Back in Dubai," Davis croons over pulsing strings and horns, "there's a song and they sing it there all the time / Going home to the smiles on the faces of kids who remind me / Dubai is mine".

Soon, an anonymous poster reported having found a vinyl of Back in Dubai and a cassette of Life in the Emirates in a dusty drawer. With some encouragement and coaching, these old recordings were converted to digital audio and uploaded to the internet. Many were happy ("I've been searching for YEARS (literally)," wrote one grateful downloader), but few more so than Danny Traynor, a Briton born in Dubai in 1979. "Back in Dubai is one of my earliest memories," he said by e-mail. "A copy was brought back with us when we repatriated to the UK and I listened to it for years before it was finally mislaid." Traynor started hosting both tracks on his website, and he suddenly started receiving hundreds more visitors, mostly "former expats homesick for Dubai".

Eventually, electronic word of all this reached Brady, who two months ago decided to reissue some old Establishment songs through cdbaby.com, where you can now, 30 years after the song was recorded, purchase a CD or mp3 download of Life in the Emirates and Other Songs (tracks include Beneath the Qatari Sky, Mick the Expat and Love in Manama). "Sales have been steady," Brady reports. "And I've been hearing from people that I haven't seen for decades. We've moved on a bit and have grey hairs, but it's good to hear from people."

I ask whether he's heard of Sal Davis, who long ago returned to Africa, where (after an extremely brief stint in Kenya's parliament) he still performs on the hotel circuit. "You know," he said, laughing. I met Sal once. I was playing a hotel in Nairobi, and he played at the Hilton there. Call the Hilton, they'll know where he is." * Peter C Baker