The Grammys push for diversity is evident in the latest batch of celebrated recordings.

Its parent organisation, The Recording Academy, announced the 2021 inductees to the Grammy Hall of Fame with 12 song and 17 albums, across a number of genres, including hip-hop, soul music, country and grunge.

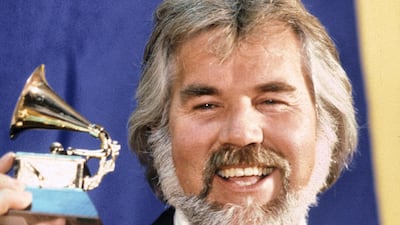

When it comes to tunes, 1978's The Gambler by the country crooner Kenny Rogers is on the list, along with 1952's Solitude by Billie Holiday, 1978's YMCA by the Village People and the 1985 charity celebrity single We Are the World produced by Quincy Jones and featuring Michael Jackson, Lionel Richie and host of other 1980s pop stars.

Seven seminal debut albums are also highlighted, including Bruce Springsteen's Greetings from Asbury Park, NJ (1973), Pearl Jam's 1991 influential grunge release Ten, The Cars's eponymous 1978 new-wave opus and Patti Smith's Horses, released in 1975.

With works needing to be a minimum of 25 years old for consideration, the hip-hop titles chosen come from artists who spearheaded the evolution of the genre. They include The Beastie Boys's groundbreaking 1986 album Licensed to Ill and A Tribe Called Quest 1993's jazz-rap odyssey Low End Theory.

Other albums honoured are So (1986) by Peter Gabriel, Trio (1987) by Dolly Parton, Linda Ronstadt and Emmylou Harris and 1969's Hot Buttered Soul by Isaac Hayes.

“We are proud to announce this year's diverse roster of Grammy Hall of Fame inductees and to recognise recordings that have shaped our industry and inspires music-makers of tomorrow," said Harvey Mason Jr, interim president and chief executive of the Recording Academy.

"Each recording has had a significant impact on our culture, and it is an honour to add them to our distinguished catalogue."

Here are five other songs inducted into the 2021 Grammy Hall of Fame:

1. 'Copenhagen' by Fletcher Henderson and His Orchestra (1924)

2. 'Clean Up Woman' by Betty Wright (1971)

3. 'Don't Stop Believin' by Journey (1981)

4. 'Time Is On My Side' by Irma Thomas (1964)

5. 'Wreck of the Old 97' by Vernon Dalhart (1924)

_________________

Read more:

How do the Grammy Awards work and why are they so controversial?

Grammy Awards rename world music category to avoid 'connotations of colonialism'

_________________