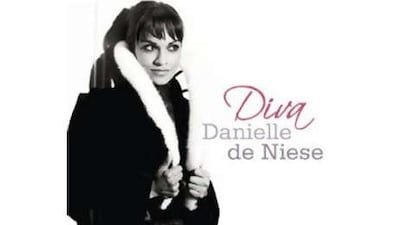

The operatic world gets terribly excited when a singer emerges who is both musically exceptional and highly attractive. Such prodigies are few and far between, but Danielle de Niele is the latest glammed-up soprano on the block, following in the footsteps of operatic beauties from the great Maria Callas to the Welsh mezzo warbler Katherine Jenkins. Luckily, the 31-year-old does have substantial talent to back up the image, even if this collection of arias by Mozart and Handel (many already featured on her two previous albums) fails to excite. De Niele, who grew up in Australia and America, is of Sri Lankan, Dutch and Scottish descent, and she made her debut at the Metropolitan Opera at just 19, so she is clearly not short of the sort of drive necessary in the competitive arena of opera. And unlike Jenkins, De Niele has proved her stamina and acting skill on the operatic stage (and on film, when she appeared in Hannibal with Anthony Hopkins) and continues to do so, having received rave reviews for her performance as Cleopatra in Handel's Giulio Cesare at Glyndebourne. As for this album: well, the Handel and Mozart numbers are very good, the Karl Jenkins reboot of Palladio as Exsultate, Jubilate is horrendous and the new "arias" by James Morgan and Juliette Pochin, based on old works, are tolerable. Her emotional range does not quite reach the depths necessary for Mozart's Laudate Dominum - perhaps with time, her voice will grow richer in the lower register - but that she is a talent worth watching remains undisputable.

Liszt: 12 Etudes d'Execution Transcendante

Alice Sara Ott (piano)

(Deutsche Grammophon)

The young German-Japanese pianist's second CD takes on some fiendishly difficult works - both technically and musically - by Liszt and wins: her agile fingers, skillful and restrained, control of the instrument's dynamics and the delicate clarity of the many-layered musical lines are supreme.

Great Strauss Scenes

Christine Brewer (soprano), Eric Owens (baritone), Atlanta Symphony Orchestra/Donald Runnicles

(Telarc)

Salome and Elektra, two of the greatest operatic dramas of Richard Strauss, offer up memorable tunes and lush orchestration, and here the American soprano Christine Brewer gets through two great scenes from each, and one from Die Frau ohne Schatten (The Woman Without A Shadow).