For The Script, the pandemic has proved to be the great restart.

The Irish-pop rock group were in the middle of their biggest run of arena concerts when the plug was pulled as a health and safety measure against Covid-19.

What was thought of as a slight pause in activity proved to be the premature end of their Sunsets and Full Moons tour, four weeks after it began.

"It was understandable but really sad because everything was going great. We were doing this arena tour and then suddenly, after a show in Aberdeen in March, we were basically told go home,” recalls singer Danny O'Donoghue before their Dubai Airshow Gala Dinner at Atlantis, The Palm on Wednesday.

"And then something like that happens and you lose all your momentum it makes you wonder what you want to do as a band. One thing that that became increasingly clear was that we couldn't just return to the stage, two years later, and pretend nothing happened.

“The whole world has changed irreversibly and the phenomenal thing about it is that everyone experienced this together.”

Back to the future

Such insights meant making a hard decision.

Where peers went back on the road to musically pick up where they left off, The Script cancelled their Sunsets and Full Moons tour and went back to their past.

Spending lockdown at home and going through the group’s catalogue, O'Donoghue says the rallying power of their biggest hits, such as Hall of Fame and Superheroes was fit for the times.

"What people need – and what I need – is that sense of familiarity and just going back up and living life again," he says.

"And that's not the energy of the Sunsets and Full Moon album, that's more the energy of The Script as a band and playing our biggest songs. Also, we just wanted to go back and play again without the pressure. We know these songs and want to celebrate that history."

To set the stage, the group released Tales from the Script: Greatest Hits.

Released last month, the band's first compilation features 16 singles taken from six albums, in addition to new song I Want it All.

Their private Dubai show will serve as ample preparation for next year’s nostalgic world tour in more ways than one.

Their November 17 performance is a day short from when the group first played in the UAE a decade ago, also at Atlantis, The Palm.

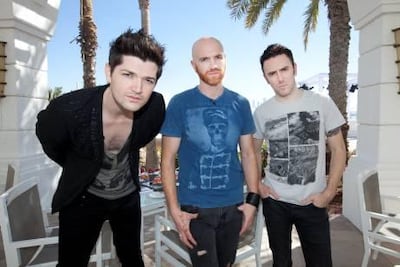

When The National met the group this week they were at the resort’s swanky Royal Bridges Suite, with its panoramic view of the Dubai skyline.

But the last time we met was a decade ago in that small artist tent behind the stage in Nasimi Beach.

“Well this is progress,” drummer Glen Power remarks with a chuckle.

“But in a way, it does make everything more special because we are trying to recapture the energy that we always had, stretching right back to those days.

“And that has been the hardest part about the pandemic for many musicians and creatives, in that they are used to living with a certain level of adrenalin from constant performances it’s hard to just stop.

“As soon as we hit that stage in Dubai again, it’s going to feel exciting and natural.”

Following The Script

As the group embarks on their first official greatest hits tour, the audience will also get a chance to hear how many anthems the trio have accumulated since forming in Dublin in 2007.

Their self-titled debut album, released a year later, was a dream start after it topped the UK charts and they landed a US number one with the single Breakeven.

While the group has gone on to notch up more success with hits such as For the First Time and Hall of Fame, the international music press had a hard time making sense of their deft blending of pop, rock, crooning and rapping.

"We were viewed as rock band but I swear to God I thought I was part of an alternative hip-hop band," O'Donoghue says.

"We were, singing, there was rap and [guitarist Mark Sheehan] would do spoken word. We were playing piano with hard hip-hop beats and each record had so many different styles. I think we were one of the first groups from that time just doing these genre-less, multi-format albums"

It was only through preparing Tales from the Script: Greatest Hits that O‘Donoghue began to see some of the effects of their work.

While not taking complete credit, he does see the connection between The Script’s eclectic sound and some of today’s biggest artists such as UK superstar Ed Sheeran and US bands Imagine Dragons and OneRepublic, all of which celebrate their hip-hop influences.

“We were one of the only European bands doing that fast tempo vocals and melodic raps," he says. "And this was even before Ed Sheeran.

“Now I am not saying that we spawned him and others but there is a definite tip of the hat, in the same way we tip our hat to others.

“Instead of being the ball that smashes everything, we liked being a link in the chain.”