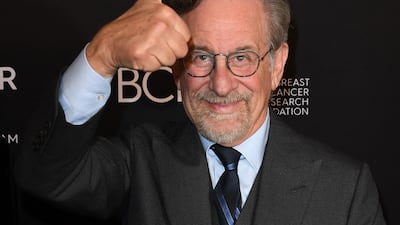

Steven Spielberg is joining the Netflix family. The acclaimed director's production company Amblin Partners has signed a deal with the streaming giant to produce films annually for several years.

The agreement comes three months after industry publication The Hollywood Reporter said Amblin was partnering with Stranger Things creators Matt and Ross Duffer to adapt Stephen King's horror fantasy book The Talisman for Netflix.

"At Amblin, storytelling will forever be at the centre of everything we do, and from the minute Ted [Sarandos, co-chief executive of Netflix] and I started discussing a partnership, it was abundantly clear that we had an amazing opportunity to tell new stories together and reach audiences in new ways," Spielberg said.

The latest deal also means Spielberg, an Oscar-winning director of classics such as ET the Extra-Terrestrial, Schindler's List and Saving Private Ryan, has had a change of heart with regards to streaming.

The director had previously argued that films seen primarily on television should be eligible for Emmys and not Oscars.

In an acceptance speech at the Cinema Audio Society’s awards in 2019, when he was being honoured, Spielberg spoke of the need to preserve “the motion picture theatrical experience”.

“I’m a firm believer that movie theatres need to be around for ever … There’s nothing like going to a big, dark theatre with people you’ve never met before and having the experience wash over you. That’s something we all truly believe in,” he said.

Netflix responded with a tweet: “We love cinema. Here are some things we also love: access for people who can’t always afford, or live in towns without, theatres; letting everyone, everywhere enjoy releases at the same time; giving filmmakers more ways to share art. These things are not mutually exclusive.”

Netflix, which plans to release more than 70 movies this year, sends some of its films to cinemas for limited runs. The company operates the world’s largest streaming service with nearly 209 million subscribers worldwide, according to Reuters.

Amblin produces several films beyond the ones that Spielberg directs, with recent projects including 2018 Best Picture Oscar winner Green Book and the 2019 First World War drama 1917.

Spielberg's latest film, a remake of the 1961 musical classic West Side Story, is set to be released in December. The film stars Ansel Elgort and Rachel Zegler in the lead. Rita Moreno, who starred is the original film, will also make an appearance.

– Additional reporting by Reuters