Here’s the thing about Ramadan television – you have to settle into its rhythm or it can feel overwhelming.

As the holy month approaches, expected to begin around March 1, hundreds of productions, from premium dramas and variety shows to culinary exhibitions and religious programming, will flood our screens. This creates the kind of fierce competition across dozens of major Arab broadcasters that would be broadly unthinkable for western counterparts. And I just love it. If variety is the spice of life, the sheer abundance of eclectic shows aired during Ramadan is akin to the most lavish iftar buffet you can experience in many of the UAE's leading hotels.

But there is a method to the madness. Expect stations and streaming platforms to begin teasing their key titles before unveiling the full slate only days before Ramadan begins. As for the timings, we may have to wait, in some cases, until just hours before the first day of Ramadan. This approach is all designed to maximise the chances that rival programmes don’t air at competing times.

And once all that strategising is done, which increasingly feels futile, as many titles are also available on demand and through daytime repeats, it’s up to us viewers to find the time and tenacity to catch some of the best content the region has to offer.

As an avid viewer of the season, I find the late nights in front of the TV worthwhile. A high-profile Lebanese drama about a town enforcer’s search for his missing son may be vastly different from a heart-warming Emirati documentary series about the joys of charitable deeds. Yet, what connects them is the shared creative drive to entertain the whole family through emotive storytelling with an ethical heart at its core.

In Ramadan dramas, the good character almost always prevails – or falls on their sword for the greater good.

This is best illustrated in the works of Egyptian actor Mohamed Ramadan, who has released a stream of successful dramas throughout the holy month over the past 10 years, capturing all the notes demanded by viewers – action, comedy, melodrama and reflection. In 2022's Meshwar, he plays a man on the run from a ruthless cabal of businessmen, an experience that forces him to re-examine his questionable priorities in life. Meanwhile, in the 2019 hit Zelzal, he portrays Khalil, who miraculously survives an earthquake that devastates his neighbourhood and becomes a guiding light to his community, emphasising the importance of family and elders. Meanwhile, in the 2016 crime drama Al Ostora, Ramadan portrays the titular character, a man striving for redemption, yet ultimately surrendering to his fate after a life steeped in crime. I wish I could tell you what he’ll return with this year, but like everyone else, I’ll have to wait for the big reveal.

These powerful emotions are also reflected in the many socially conscious documentaries and lifestyle series created to highlight and inspire the values of Ramadan. Al Dunya B’Khair – Awnak, a local hit in 2022, was a heartfelt daily program that took viewers inside the UAE Red Crescent, showcasing their humanitarian work across the Arab world. It served as a reminder to embrace the spirit of giving, encouraging us to make a difference in our own small ways. While the annual series Al Sadma remains a candid camera show with a purpose, it places members of the public across the Arab world in socially fraught situations to observe their reactions, offering insight into the current state of societal norms.

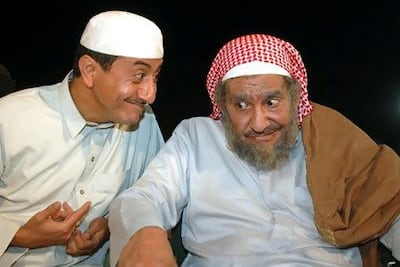

With Ramadan offering a rare opportunity for families to come together to break the fast, comedy also plays a significant role. The holy month has long been home to ground-breaking comedies, from Saudi Arabia's Tash Ma Tash to Syria's Maraya, both of which used sharp and, at times, fierce satire to highlight key issues in Arab society and the human condition. Their morally driven storylines often explored the family and societal dangers of anger and greed, delivering poignant messages through humour.

The Arabic prank show, epitomised by the ratings juggernaut of Egyptian comedian Ramez Galal's annual series, has been a television institution for about 50 years, with celebrities and public figures getting pranked on screen.

Once again, there are deeper motives at play in broadcasting many of these shows just after sunset. "They are a mood booster during the month," Mazen Hayek, a media consultant in Dubai and former official representative for MBC, told me in an interview last year. "At the end of the fasting day, people are a little tired, and after they eat and complete their prayers, they often want to unwind together as a family. This is why prank shows and comedies are firmly established in that post-prayer, post-iftar slot, followed by more hard-hitting dramas. That has always been the case for decades because viewers need that dose of fun after a long day."

At its core, this is what Ramadan television offers. More than just melodrama, it serves a greater purpose – bringing us together and offering fleeting moments of insight or much-needed relief from an increasingly uncertain world. It’s an annual chance to tune out from the chaos outside and lose ourselves in stories that resonate, entertain and remind us of the emotions we all need to feel.