British-Palestinian writer Selma Dabbagh came out of London's Covid-19 lockdown with a new outlook: “In terms of my life going forward, two things I want more in it are love and resistance — they are sort of my mottos. Just trying to take a stand about the things I really believe in has become more critical to me,” she says.

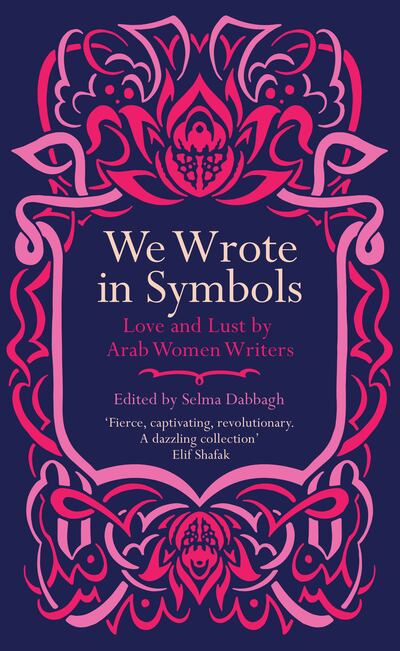

Amid the pandemic, Dabbagh has spearheaded a rather revolutionary project. Her anthology, We Wrote in Symbols: Love and Lust by Arab Women Writers, was published in September 2021, and features the work of 75 female Arab writers, including academics, archivists, biographers, doctors, engineers, homemakers, lawyers, mothers, playwrights, performers, professors and novelists, as well as medieval concubines, court singers, princesses and political exiles.

Many of the contributors are Muslim, or come from Muslim heritages, where writing openly about certain topics may not have been seen as “appropriate” at the time, but was in fact far more prevalent centuries ago, says Dabbagh. Her work shares profound parallels with the motivations that led to the founding of Muslim Women’s Day in 2017 — marked annually on March 27 — which was initiated to help amplify Muslim women’s voices.

“The idea came from the classical works,” says Dabbagh, who couldn’t help but notice that female writers were far more vocal about love and sensuality in poems from the pre-Islamic era, all the way up to 1492, which is when Muslim rule fell into a decline after losing Andalusia.

author

“The women’s writing during this period is quite assertive on issues of love. Then you have almost a shutdown of 500 years between 1492 and the 19th century, where very little writing by women was being produced and the writing that was coming out was very pious and very muted. Then at the end of the 19th century it starts picking up, and these voices are getting more and more exploratory and outspoken. I thought it would be quite interesting to put writing from the two periods together."

Encompassing everything from wild fantasies to wedding nights and flirtatious banter to intimate moments, set everywhere from a Palestinian refugee camp to Dubai International Airport, We Wrote in Symbols explores themes of imagination, anticipation and female desire by Arab female writers.

Dabbagh pitched the project to London publishing house Saqi Books, which specialises in stories from the Middle East. “I thought they would be a nice home for this idea because I wanted it to come from somewhere that knew the market and wouldn’t try to scandalise it, over-sexualise it or orientalise it,” explains Dabbagh. “As I was putting it together, I was really thinking about other women, I was trying to get this atmosphere of somewhere between a harem and a book club — women chatting over the era.”

Each piece of writing is a work of fiction, except for one letter sourced from 11th-century Basra, which Dabbagh says is a “rant of fury” written by a woman to her master. She believes the fact that the anthology centres on fiction is an important one, as it gives female Middle Eastern writers a chance to freely tell stories without attaching their own personal lives to those of their characters’.

“I feel that it’s quite important for women fiction writers to be able to say, ‘I’m going to write a story where the characters do this thing, and it may be sexual or romantic but that has nothing to do with the writer’s life,’” explains Dabbagh. “This is what was happening with me previously as a fiction writer, I didn’t know if I necessarily wanted to touch on these points in case readers saw me in the female characters — though now that I’m older I don’t really care as much about that.”

Dabbagh says Muslim and Middle Eastern female writers are subject to far more scrutiny than their male peers, and she attributes these double standards to the way that shame and female desire have been construed over the years. But an underlying motivation behind this anthology was to show that this was not always the case.

“There were periods of history where women’s desire was actually more understood in Islam, where women were more able to assert and express it — it came within certain prescribed relationships, but it was not connected to shame,” she explains. “This isn’t a religious book or historical book, but I wanted to bring more attention to this idea of love in Islam, and in the Arab world — that it’s something that happens, and particularly with sexuality, that you have these extraordinary women from before 1492 who were poets, princesses, singers, courtesans who used language and love as a sort of currency, of social elevation, and of empowerment.”

Earlier this year at the Emirates Airline Festival of Literature, Dabbagh starred on a panel discussing desire in Arab writing, and the challenges and limits of expressing desire in literature in this region. She also hosted a workshop on creating vivid settings through writing.

“All societies have taboos, most of them around women’s sexuality, but taboos are kind of fluid, they move, and this was a gentle way of kind of tracing a pattern of that,” she says.

Apart from editing and contributing to anthologies, Dabbagh’s 2011 novel Out of It, which is set during the 2008-2009 Gaza conflict, was critically acclaimed and has been translated into numerous languages. She has also just finished a draft of a new novel, which is set in Jerusalem in 1936, and will be published in 2023.

“It was an extraordinary period in Palestinian history. It was a very cosmopolitan world in Jerusalem at the time, and there were a couple of women in particular who I’m inspiring the novel around."

We Wrote in Symbols: Love and Lust by Arab Women Writers is available at uae.kinokuniya.com for Dh90