For many in the art world, artist Chant Avedissian is known for his nostalgic stencil paintings of Egypt’s Golden Age. In 2013, his series Icons of the Nile (1991-2010) set a record for the highest price for a piece by a living contemporary Arab artist when it sold for more than $1.5 million at Sotheby’s Doha. Avedissian died in Cairo in 2018.

But four brothers from Downtown Cairo remember him as a neighbour, a childhood friend and the artistic protege of the city’s culturally active Armenian community. Their father, George Mikaelian, a bookshop owner and arts patron, supported Avedissian’s work throughout his career in Egypt. “I kept asking my father, 'What are we going to do with all these paintings?'” says Hratch Mikaelian, the eldest of the brothers. “He just said: 'You will see, you will see.'”

George's ensuing collection, amassed over decades, is now the subject of the exhibition Chant Egyptien, on view at ArtTalks in Cairo. It shows how Avedissian experimented prolifically with a variety of styles and mediums. “Every one of Chant’s exhibitions had its own subject and style; he developed his styles a lot,” says Chris Mikaelian, Hratch’s younger brother who took art lessons at the same studio as Avedissian.

Armenian folkloric dance traditions, the lives of rural Egyptian women, Islamic arts and Egypt’s ancient heritage were among the subjects that the artist captured in painting, photography and costume design. They were the stepping stones for his Icons of the Nile portraits, which he produced in the later decades of his life.

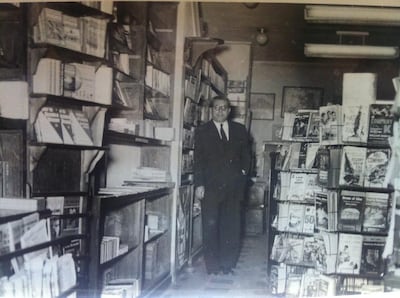

Owner of the Reader’s Corner bookshops, George was born in Cairo in 1914 to Armenian parents. The chain's main branch was in Downtown Cairo, with others in Egypt’s luxury hotels, including Le Meridien and Nile Hilton.

Beyond selling books, George was a founding member of the committee Les amis de la culture Armenienne, which aimed to support the younger generation of Egyptian-Armenians. “Some of the meetings were held at the Reader’s Corner bookshop,” says Hratch, who liked to listen in on the conversations. “They were a very interesting group who came from different walks of life, and they really cared about the culture of what they called the future generation, which was me and my brothers at the time.”

But George also took a personal interest in art and bought works from young Egyptian artists such as Ismail Sami and Hassan Heshmat. “My father always encouraged young artists. At that time nobody gave them exposure because very prominent Egyptian artists dominated the scene,” says Hratch. “Not all of them were very good, but he kept buying their works to encourage them.”

family friend of the late Chant Avedissian

Avedissian, the son of Armenian refugees, was born in Cairo in 1951, and lived two blocks from the Reader’s Corner. “Our parents knew each other, and we were part of the same clubs,” says Chris, who has a passion for fashion design and works as an arts consultant today. “Chant and I took private drawing lessons together at the same studio. But Chant didn’t need any lessons because he was so talented. He could produce an artwork in just a few seconds.”

Their teacher was Alexandrian artist Nora Azadian who helped Avedissian plan his first exhibitions. “With the help of Mrs Nora, Chant started organising exhibitions from a young age. My father supported him because he liked his work,” says Chris. “It was a relationship that went beyond buying and selling art.”

But the opportunities for young artists in Egypt were limited. “I used to see Chant at my father’s shop and ask him frankly, 'What are you doing?'” recalls Hratch. “Because I could see the challenges that young Egyptian artists faced.”

In 1970, Avedissian travelled to Canada to pursue his studies at the School of Art and Design in Montreal. Then, after a brief return to Egypt, he moved to Paris in the late 1970s to attend the National Higher School of Decorative Arts.

Avedissian first began his explorations of Egyptian culture in the '70s. “He had just returned from Montreal, and maybe he was feeling nostalgic about Egypt and its ancient history,” says Chris. Among the works on display at the exhibition today, is a series of paintings derived from the Pharaoh Akhenaten's daughter, who appears in ancient portrayals with an elongated head. “They are among my favourite of Chant’s work,” says Chris.

He also took an interest in photography, with the support of photographer Shake Alban, who ran a studio in Cairo. “He took excellent photographs of the mosques of Old Cairo, and also travelled to Upper Egypt. He used a Rolleiflex camera with black and white film. At the time, it was difficult to find negative film and printing paper in Egypt,” says Chris, who worked at Alban’s studio. “I helped to source the materials, and he gifted me his collection of photographs.”

And while Avedissian celebrated Egyptian culture, he was involved in Cairo’s Armenian community. “He was always happy to help and contribute paintings or postcards,” says Chris. In the mid-1970s, he designed the costumes for the Armenian folkloric dance group Sardarapat. Two of the ensuing designs are part of George Mikaelian’s collection today, and are on display at ArtTalks.

The experience led to the artist producing a series of paintings of Armenian dancers, which is also on show at the exhibition. “You can feel the movement in the paintings, as if they are really dancing,” says Chris.

In 1981, Avedissian returned from Paris and began an important collaboration with Hassan Fathy. The pioneering architect introduced Egypt’s vernacular mud and adobe building traditions to modern design. Travelling together across rural Egypt, the pair produced a book of Fathy’s work, accompanied by Avedissian’s photographs.

Throughout, Avedissian's photographic endeavours seeped into his paintings. “He painted life in Egyptian villages, the homes in the Nubian style, historic mosques,” says Chris. His paintings of the women from rural Egypt, known as the Falahas, which he began in the '70s, also form part of George’s collection.

These motifs and influences would no doubt culminate in the renowned stencil paintings of the 1990s, which the artist became known for until his death in 2018. The exhibition includes some of these works, which are on loan from other private collections.

The Reader’s Corner still exists in Downtown Cairo, and George’s sons took over the business after his death in 1986. The shop has now evolved into an arts advisory and framers. Yet Cairo’s once-burgeoning Armenian community has dwindled considerably.

Hratch says that going through the collection overwhelmed him with memories. “When we took the paintings out of storage, we saw them completely differently. Some had been packed for 30 or 40 years. I get emotional talking about it because it was our childhood and our youth. It was a beautiful period where there was a lot of collaboration. Everything was done with love, there was no conflict or competing interests.”

He hopes the exhibition will inspire a younger generation of Egyptian artists. “There’s a serious movement of Egyptian art that is noticeable in Zamalek and Downtown Cairo. We feel that Chant should have his position there as well, as an Egyptian-Armenian artist.”

Chant Egyptien is on view at ArtTalk in Zamalek, Cairo, until Saturday, January 15