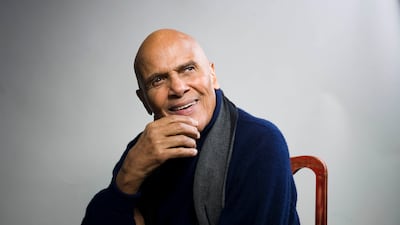

Harry Belafonte, the entertainer who introduced a Caribbean flair to mainstream US music and became well known for his deep personal investment in civil rights, died on Tuesday in Manhattan, his publicist said. He was 96.

The barrier-breaking artist-activist died of congestive heart failure at his New York home, the publicist's statement said.

Born in Harlem to a Jamaican mother and a father from the French territory of Martinique, the calypso singer and actor spent part of his childhood in Jamaica before returning to New York — a binational upbringing that shaped his musical and political outlooks, and led him to campaign tirelessly for racial equality.

Belafonte's calypso, the genre of Caribbean music that drew from West African and French influences, rocketed him to fame in the middle of post-Second World War prosperity and suburbanisation.

His third album, entitled simply Calypso and released in 1956, became the first LP to sell more than one million copies in the US.

The album featured what became Belafonte's signature song, Day-O (The Banana Boat Song).

Based on a Jamaican folk tune, he sings with a Caribbean accent: “Stack banana 'til de morning come / Daylight come and we wan go home.”

Belafonte scoffed at suggestions that the song was simply feel-good dance music, calling the track a rebellious take on workers who were demanding fair wages.

Even in his early career, Belafonte did not shy away from controversy.

He starred in the 1957 film Island in the Sun as an upwardly mobile black politician on a fictional island who becomes involved with a woman from the white elite, in one of Hollywood's earliest depictions of interracial romance.

In 1954, he became the first African-American man to win a Tony Award for his role in a Broadway musical, John Murray Anderson's Almanac.

Six years later, he became the first African American to win an Emmy Award for Tonight with Belafonte, his musical TV programme. He also won three Grammys.

'Struggle'

But his life's work went far beyond performance, with his music and movies taking a supporting role to his activism.

"Harry Belafonte’s accomplishments are legendary and his legacy of outspoken advocacy, compassion and respect for human dignity will endure," President Joe Biden said in a statement.

"He will be remembered as a great American."

As the civil rights movement grew in momentum, Belafonte took on a trailblazing role. He became a confidant of Martin Luther King Jr and personally opened his wallet to fund the cause.

“When people think of activism, they always think some sacrifice is involved, but I've always considered it a privilege and an opportunity,” he said in a 2004 speech at Emory University.

Belafonte took Dr King and the Birmingham, Alabama, pastor Fred Shuttlesworth to his New York apartment to plan out the 1963 campaign to integrate the notoriously racist southern city.

When Dr King was thrown into a Birmingham jail, he raised $50,000 — nearly $500,000 in current value — to post his bail, at a time when the rise of pop music was bringing wealth and lavish lifestyles to many entertainers.

“Belafonte's global popularity and his commitment to our cause is a key ingredient to the global struggle for freedom and a powerful tactical weapon in the civil rights movement here in America,” Dr King said.

“We are blessed by his courage and moral integrity.”