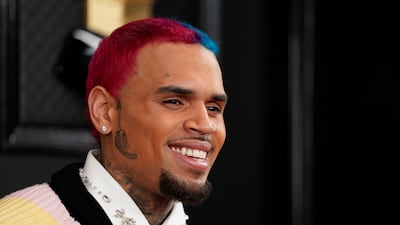

Singer Chris Brown is being sued for rape in California, with his alleged victim claiming he drugged her and attacked her on a yacht at rap mogul Diddy's Florida home.

The woman, identified in court papers only as Jane Doe, is demanding $20 million in damages from the R&B star.

According to the civil suit, which was filed on Thursday and seen by AFP, Brown invited the woman – described as a choreographer, dancer, model and musical artist – to the yacht shortly after she arrived in Miami on December 30, 2020.

She says the drink he offered her there made her feel "disoriented (and) physically unstable".

The filing says Brown led her into a bedroom where, despite her protests, he raped her.

"The traumatic events that Plaintiff Jane Doe experienced shock the conscience and should horrify all of us," says the suit, filed in Los Angeles.

"The time has come to send a message to Defendant Chris Brown that enough is enough.

"Accordingly, Plaintiff Jane Doe brings this complaint seeking justice for herself (and also with the hope it may serve as an example for others) who may now or have in the past found themselves at the mercy of Defendant Chris Brown."

Lawyers Ariel Mitchell and George Vrabeck told TMZ their client did not report the alleged attack to the police because she was embarrassed.

Grammy Award-winning Brown took to Instagram after news of the suit broke.

"I HOPE YALL SEE THIS PATTERN OF [blue cap emoji]," he wrote. The blue cap emoji is used to denote untruths.

"Whenever im releasing music or projects 'THEY' try to pull some real [expletive]."

Brown did not specify who "they" were.

In 2009, Brown was convicted of beating fellow singer Rihanna, his girlfriend at the time, who missed the Grammy Awards because of her injuries.

He also was previously accused of raping a woman in a luxury Paris hotel. He denied the claim, and was not charged.