Artificial intelligence has a crucial role to play in the pursuit of net-zero emissions, but it cannot do it by itself until new technologies to expand sources of energy come onstream to meet growing demand.

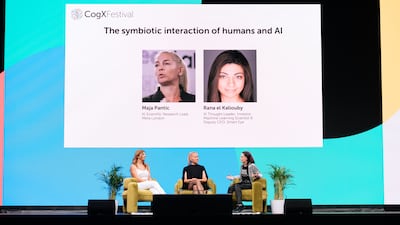

A senior manager at oil company Shell joined innovators and futurists at the CogX Festival in London in sketching out the effects of AI on the energy revolution.

“AI and digital have a really fundamental role to play in the energy transition,” said Amy Challen, general manager for artificial intelligence at Shell.

“AI is not the answer. The answer is physical and chemical technologies and a massive shift in the way we do things. But AI is a massive enabler.”

Caroline Cochran, the chief operating officer of Oklo, a company developing advanced fission nuclear power plants, agrees that AI can and will help on the road to net zero as strides are being made in other areas as well.

“There’s technologies that already exist, it’s just a question of deploying them,” Ms Cochran said.

Jack Hidary, chief executive of SandboxAQ, said AI technology was only a taste of the progress that quantum mechanics would bring.

Mr Hidary said the technology underlying the exploitation of large language models could be used for simulation of proteins, not just computer bits.

He gave two examples on the cusp of change: drug testing for new treatments; and battery technology to service individual homes.

“Every single molecule designed to be a drug will go through simulation in this computing revolution, which will speed up design, drop the costs and most importantly, increase the chances of success in a real clinical trial," Mr Hidary said.

"When we think about batteries – not just electric vehicles but buildings like your home, offices like your home – we need batteries in every single one of them to draw on the clean energy such as solar or wind, store it and use it 24 hours, turning solar, for example, from an intermittent source to a baseload energy source.

“Now with these tools of simulation and AI we can have this next revolution.

"We can understand different elements to create alternative battery technologies, aluminium-based batteries, zinc-based batteries and other chemistries."

CogX Festival in London - in pictures

Ms Challen said Shell was able to use AI far more today than just a few years ago.

“We’re much better than we were five years ago,” she told the CogX Festival.

“We’ve got over a hundred AI-powered applications in development and deployment.

"We’ve got over four trillion rows of sensor data in the data lake and this number goes up every month, and we’ve got over 17,000 pieces of equipment being monitored in our predicting maintenance programme.”

Technology could yet provide the means of harvesting solar power from space, according to Pablos Holman, a general partner in Deep Future and former executive at the Jeff Bezos-backed space venture Blue Origin.

“Solar panels in space will get eight times as much energy and you beam it down to Earth through radio waves,” Mr Holman said.

“In this decade, doing solar in space will become the lowest-cost baseload energy anywhere on earth.

“You don’t need storage, you don’t need transmission lines and its coming to you carbon-free.”

But that is not to say the development of AI that accelerates the process to net zero is without its challenges.

“Anyone can do proof of concept and get very excited about it, but it can be really hard to actually realise value," Ms Challen said.

“We need process changes. Unless you actually embed what you’re doing and change the way someone is doing a particular process, it’s not going to go anywhere.

“You need technology that scales – if you try and do it in a local development environment, you’re not going to go anywhere.”

“The landscape is getting more and more complex and with generative AI we see some risks being introduced with that, just because of people’s naivety about these tools and about what they can do.”

Nonetheless, Ms Challen said that Shell supports the concept of open-source software in AI.

“We actually have open sourced some of our own products," she said. "We’re also a strong believer in using open-source components in many of the models we build.”

The processing of enormous amounts of data for AI is a much more energy-intensive process than its predecessor and leading figures in the industry are now backing ventures to deliver that power.

Sam Altman, chief executive of OpenAI, has emerged as a backer of nuclear fission as the chairman of Oklo as it seeks to build small nuclear reactors.

Ms Cochran, a co-founder of Oklo, told CogX its reactors are going to be much smaller and designed to reuse existing nuclear fuel.

“We can make small power plants that have inherent safety characteristics and you can even use nuclear waste as fuel," she said.

“You need a tonne of energy for AI. We talk to the data centres who are making huge commitments in terms of decarbonising.

"They are looking for energy supplies. They are being told by utilities in those areas you can’t build here unless you bring your own power.

"We have small power plants that can run 24/7, which is important.

"They need a clean energy source that can do that 24/7 and there’s really not much other than nuclear that can do it.”