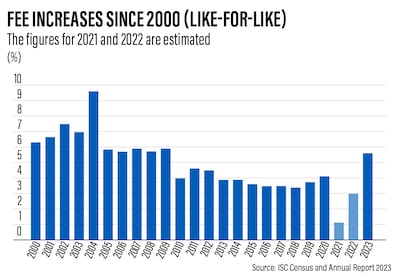

Fees at the UK's private schools have risen by 5.6 per cent from last year, according to figures from the Independent Schools Council.

The average day school fee has increased by 5.8 per cent, with the majority of day schools charging between £3,000 and £5,500 a term.

The ISC said that assistance with fees increased by 5.9 per cent to £1.2 billion.

“Fee assistance provided by ISC schools has again increased,” the ISC said. “Almost 30 per cent of pupils receive some form of fee assistance through the school, and the average value of a bursary has also increased to £11,800.

“There is a trend towards more high-value bursaries. An increasing number of pupils receive a transformative bursary worth 75 per cent or more of fees.”

Meanwhile, the ISC said the average means-tested bursary was worth £11,807 per annum, an increase of 8.9 per cent compared with last year and that 9,620 pupils paid no fees at all for this academic year, an increase of 23 per cent.

Overall, there are now 554,243 pupils at 1,395 ISC member schools, an increase of 9,927 on last year.

Economic contribution

The ISC census also referred to research by Oxford Economics that shows that independent schools in the UK contribute £16.5 billion to the economy, support 328,000 jobs and generate £5.1 billion in tax revenue.

“They save the taxpayer £4.4 billion every year by providing for hundreds of thousands of pupils who would otherwise be competing for state school places, often in the most oversubscribed areas of the country,” said Barnaby Lenon, chairman of the ISC.

Analysts said the rise in school fees was modest, given the wider inflationary environment.

“School fee inflation of 5.6 per cent on average, or 5.8 per cent for a day pupil, may be hard to stomach for parents already grappling with higher costs elsewhere,” said Alice Haine, personal finance expert at Bestinvest.

“But considering CPI inflation was 10.1 per cent for the same January-to-January period, this is a better outcome than expected when you consider the heavy demands on school budgets posed by rising costs, including wage inflation.”

However, that outcome is not expected to last and fees are predicted to rise again next year, Ms Haine warned.

“Add in the prospect of a future Labour government honouring its pledge to add 20 per cent value added tax to school fees and many parents may be forced to abandon plans to privately educate their offspring, opting for a taxpayer-funded state education instead,” she added.