Experts say they have found new decoration details in the coronation chair which has been used to crown British monarchs for hundreds of years.

The chair will be used for King Charles III's coronation, which takes place at Westminster Abbey in London in May.

Krista Blessley, Westminster Abbey’s paintings conservator, believes she has found a previously overlooked part of a figure during work to clean and preserve the gilding.

Ms Blessley said: “I think they are previously undiscovered toes in the punch-work gilding on the back of the chair.

“There are areas of drapery where you can tell there would have been a figure. It might be they are figures of kings or it might be a figure of a saint. Because so much is lost we can’t really tell at the moment but I’ll do some further investigation.”

She described her pride at helping to conserve such a historic object central to the life of the nation: “It’s a real privilege to work on the coronation chair.

“It’s so important to our country’s history and in the history of the monarchy, and it’s really unique as a conservator to work on something that’s part of a working collection and still used for the original function it was made for.”

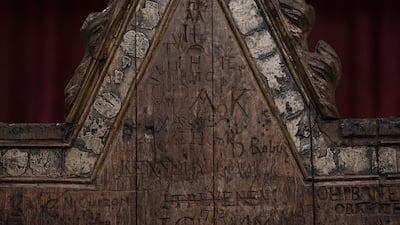

Henry VIII, Charles I, Queen Victoria and the late Queen Elizabeth were all crowned in the historic chair, which bears the scars of centuries of misuse, covered in graffiti carved by schoolboys — but areas of gilding showing elaborate birds and foliage have survived.

The chair was made circa 1300 for King Edward I to house the famous Stone of Scone and was constructed from oak, decorated with coloured glass, gilded with gold leaf and painted by the king’s master painter.

Experts debate about when the chair was first used to crown a monarch but the first confirmed use was thought to be for the coronation of Henry IV in 1399.

Over the centuries, 38 coronation ceremonies for reigning monarchs have been staged at Westminster Abbey with a few notable exceptions such as Edward VIII, who abdicated in 1936 before his coronation.

Much of the graffiti on the inside of the chair’s back rest was carved by Westminster schoolboys and visitors to to the abbey in the 18th and 19th centuries, who left their initials or names.

One tourist carved “P. Abbott slept in this chair 5-6 July 1800” on the seat.

Slithers of wood were also cut off as souvenirs and during a 1914 bomb attack, thought to be the work of the suffragettes, a small corner was knocked off.

In 2010 a major project took place to stabilise the gilding on the coronation chair and clean it. There are now checks every six months.

In preparation for the coronation, Ms Blessley has spent the past four months meticulously preserving the flaking gilding and cleaning the chair’s surface using sponges and cotton swabs.

She said: “It has a very complex layered structure, which means it’s very prone to the gilding on it flaking.

“So a large part of what I’ve been doing is sticking that gilding down to make sure it’s secure, and then I will surface-clean it and that will improve the appearance a little bit.

“If there’s little changes in humidity, the wood moves, and that complex layer structure moves — new areas will lift. I might consolidate something this month, then in two months I might need to consolidate it again.”

On the back of the chair was a painted king, either Edward the Confessor or Edward I, his feet resting on a lion.

The four gilt lions that form the base were made in 1727 to replace the originals, which were not added until the early 16th century.

Ms Blessley commented on the importance of the punchwork decoration to the gilding — intricate tiny dots used to make patterns — saying: “The punchwork is unparalleled really in quality of surviving English art of this time, we have so little that has survived.

“To have something like this is amazing.”