Britain's Office for National Statistics has released its latest census data, showing the changing ethnic demographics of the country.

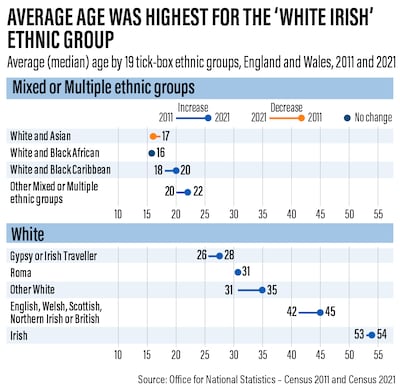

Figures show how the Irish, one of the longest-established groups in the UK, have a median age of 54, making them “significantly” older than nearly every other ethnic group.

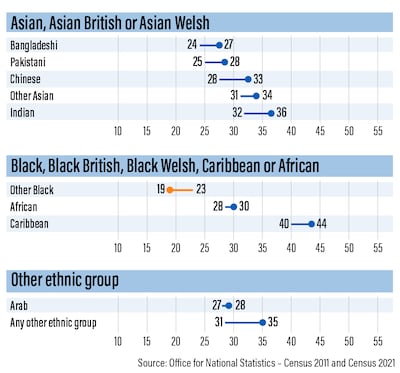

ONS data also show that respondents who identified as Arab, African or South Asian are often significantly younger than other groups in the country.

The median age of the overall population was 40.

A total of 287 ethnic groups in England and Wales were recorded in the census, which took place on March 21, 2021. The census is carried out every 10 years.

Results of the census, which have been released in instalments since late last year, show how Britain has moved from a relatively homogenous society to one that is more diverse in regards to race, religion and ethnicity.

Irish in Britain

More than 507,000 people in Britain identified on the census form as “white Irish”, with the majority born in Ireland.

Nearly a third — 32 per cent — of the white Irish population are pensioners, compared with nearly a fifth — 19 per cent — of the total population in England and Wales.

Britain has long had a significant Irish population, with millions of migrants crossing the Irish Sea in search of better prospects since at least the late 18th century.

The end of the Second World War resulted in another large wave of Irish migrants to the country to help with reconstruction efforts. Many settled in London, but also in the heartlands of British industry, including Birmingham and Manchester.

The Irish were followed from the 1950s onwards by black Caribbean migrants and those from the Indian subcontinent.

“A large proportion of people identifying themselves as 'white Irish' on the ethnicity question will be immigrants from long ago,” David Voas of University College London told The National.

“Although there are still people coming from the Republic of Ireland to the UK to work, in any case, the numbers are possibly balanced by deaths among older generations.”

He believes that many children of Irish immigrants now consider themselves to be British rather than Irish.

However, he pointed out: “Ethnic identity isn’t like nationality; it’s intended to be stable."

These groups, while not as old as the Irish, are also ageing somewhat. For example, black Caribbean migrants now have a median age of 44, up about four years since the last census. The median age for those identifying as Indian stands at 36, also an increase of four years.

Other groups with a high median age include white Cornish (47), white Danish (47) and white Maltese (56), as well as those in the “other ethnic group” category, identifying as Greek Cypriot (47) and Japanese (49).

Britain's Arab community is staying young

The census showed more than 330,000 people in Britain identified as Arab in the census. Their median age stands at 28, significantly younger than the rest of the country.

Dr Voas said that a significant proportion of Arabs in Britain may be refugees or economic migrants, and as a result may be much younger than the overall population.

Younger, mixed race generation

Some of the lowest median ages are in the “mixed or multiple ethnic groups” category, including black British (16 years), mixed white (15) and mixed black (13).

“There are more mixed marriages/partnerships now than in the past, and the offspring from those unions are relatively young compared to the population as a whole,” Prof Voas said. “The ethnic composition of the UK is becoming increasingly diverse.”

People identifying as mixed South Asian or mixed Pakistani/British Pakistani are among the groups with the lowest averages, at below 18 years.

The category “mixed or multiple ethnic groups: Pakistani or British Pakistani” has a median age of 11 years, as does “Asian, Asian British or Asian Welsh: mixed South Asian”.

The lowest median age of all is six years, for “mixed or multiple ethnic groups: mixed South Asian”.

About 2,000 residents of England and Wales identified this way, the ONS said.