The ISIL propaganda machine has been badly damaged following the downfall of Raqqa with its flagship publication offline for its longest period, the US-led coalition said Monday.

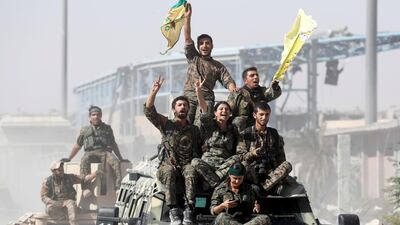

The monthly multi-language online magazine Rumiyah – which has published articles urging ISIL supporters to carry out lone wolf knife attacks in their home countries – has not been published since September after the group's former de facto capital was taken over by US-backed Syrian fighters.

Online videos posted by ISIL sympathisers rarely contain original footage with most of it made up of previously posted material, said Colonel Ryan Dillon, a spokesman for the US-led coalition against ISIL in Syria and Iraq.

The message of ISIL broadcasts has also changed from the high point of its influence when it encouraged supporters to travel to Iraq and Syria to fight, said Col. Dillon. “Now it’s more geared towards those hardcore fighters – stay, fight – and its very much military-centric as opposed to home to Utopia.”

________

Read more:

Syrian Kurdish YPG says areas east of Euphrates now free of ISIL

‘Around 4,000 ISIL fighters and their families escape from Raqqa’, report

________

ISIL made Raqqa the centre of its self-styled caliphate and was the hub of its media operations, with thousands of militants travelling there to fight under the group’s flag providing linguistic expertise.

There was an “absolute dip” in propaganda output following its loss in October, although the ease of posting extremist content for anyone with access to a laptop or cell phone has meant that the propaganda has continued, albeit it at a lesser scale.

The driving out of the militants from its former strongholds has run alongside counter-propaganda efforts by the authorities in Saudi Arabia and the UAE, said Col Dillon.

Former US president Barack Obama in 2015 announced a joint US-UAE project for a new digital communications hub to counter terrorist propaganda, following an admission that the ISIL media operation had trumped efforts by its better-funded opponents.

The Sawab centre would use “direct online engagement to counter the terrorist messaging that is used to recruit foreign fighters, fundraise, and terrorise local populations,” the state department said.

The decline in ISIL propaganda efforts mirrors the decline of its military capability, with a sharp decline of airstrikes needed against the group, and the withdrawal of US troops who will not be replaced, said Col Dillon at a briefing in London. Syrian forces in Raqqa are now focused on clearing mines from homes in the city.

Having lost all of its main strongholds, the group was returning to its roots as an insurgent force with fewer than 3,000 active ISIL fighters remaining in Iraq and Syria, he said. “They are no longer a military threat, and no longer have an army.”