NEW DELHI // The works of India's most famous artist, M F Husain, are back on display at the country's biggest art fair after being withdrawn because of fear of attack by Hindu extremists.

Hindu hardliners accuse Husain, a Muslim known as the "Picasso of India," of insulting their faith by portraying goddesses in the nude in some of his paintings, a depiction that he says symbolises purity.

A gallery showing three paintings by the artist, who is known for putting Indian modern art on the global map, said on Saturday that it was displaying the canvases again at the India Art Summit in New Delhi after getting government promises of more security.

"The summit asked us to remove the paintings due to security worries but the problem was resolved and we were able to bring the works back," said Kishore Singh, the exhibitions head at the Delhi Art Gallery which is showing the works.

The gallery displayed the paintings by Husain, 95, for a VIP preview on Thursday, but removed them hours later after receiving hate mail from a radical Hindu group which it did not identify.

After receiving threats that included a reward of $11.5 million for his death and thousands of legal cases filed against him for offending "Hindu sentiment", the Mumbai-based artist moved to Qatar in 2006 and accepted Qatari citizenship last year.

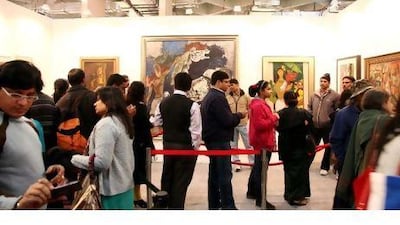

People were lining up on Saturday to see Husain's paintings, one of a musician, the other of a village woman and the third of horses, which were on display behind a newly erected barrier at India's largest contemporary art show, now in its third year.

"I think this will embolden gallery owners everywhere to show his works. We have found amazing support for displaying the paintings," Mr Singh said.

"The country cannot kowtow to right-wing Hindu fundamentalists," he said.

At the last art summit in 2009, no galleries displayed Husain's work because of security concerns, saying they feared putting visitors and artworks at risk.

Art show organisers said in a statement they had received a commitment from the culture ministry and police that "they will take all necessary measures to ensure that the art fair is completely safe for the showcase of all artists."

In 2008, Husain's works were attacked by members of the Bajrang Dal, a Hindu group, at an event in New Delhi, the same year that one of his paintings, influenced by a Hindu epic, fetched $1.6 million (Dh5.9m), setting a world record at Christie's South Asian modern and contemporary art sale.

The India Art Summit, which includes displays by 88 art galleries from India and abroad, offers global exposure for Indian artists.

It also provides a chance to test the waters for foreign dealers who believe India's booming economy is creating a substantial pool of rich buyers interested in global art.

Among the major western international names on display are Pablo Picasso, Auguste Rodin and Damien Hirst.