Amid the frenetic atmosphere of the final days of Expo 2020 Dubai, Abdo Fall is a picture of calm and poise.

Nearly every day of the world's fair, the Senegalese artist can be found outside the gates of his country’s pavilion, painting a mix of handsome portraits and vibrant impressionist images.

During the opening few weeks of the Expo visitors considered him a bit of a curiosity, but over time, he says, people began to approach him to share stories and experiences.

“It is interesting because, before, they would be curious about the work I do and I would sell them some pieces,” he says while snacking on a sandwich.

“What happened was that by seeing me coming here every day and painting, I think they felt a sense of respect because here is someone working every day because he loves what he does.”

Fall says much of that is down to an uplifting attitude intrinsic to Senegalese culture, something I begin to appreciate when visiting the pavilion as part of my tour of African countries represented at the world fair.

For someone with roots in the continent — my parents are from Eritrea — visiting Expo's African pavilions is inspiring.

Many lack the high-tech features of their European and Asian counterparts, but they are replaced with heartfelt interactions between fellow Africans working behind the stalls and counters, and those visiting Expo.

I spot Baddy Oosha at his native Nigerian pavilion, dressed for the occasion, in a dark, free-flowing agbada and a black traditional embroidered headpiece.

A regular visitor to the expo, the popular Afro-pop singer, who lives in Dubai, turned his experiences into the song Africa.

Released in November, the party ode to the motherland has been a mainstay of his club sets ever since and the return trips to the African pavilions are a muse for him, too.

“It feels like I have been travelling through Africa even by not being there. To learn about the countries and experience some of the cultures in places like Rwanda, Tanzania and South Africa gave me great inspiration,” he says.

“So I wanted to touch these countries in the song and like the pavilions show people more about Africa and maybe even change some perceptions.”

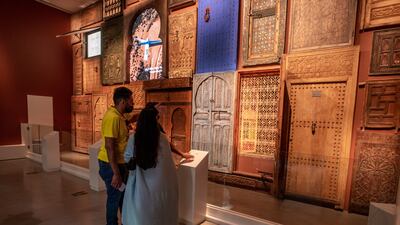

This is the enduring goal behind the majestic Angola Pavilion at the Mobility District.

Inspired by sona geometry, an ancient form of sand drawing linked to Angola and neighbouring Zambia and the Democratic Republic of the Congo, the pavilion resembles an amphitheatre with an outdoor area housing a music stage.

Inside, you see various terracotta-coloured rooms featuring Angolan floral and art installations, digital displays of the southern African country's resources and a mini theatre screening various programmes about Angolan culture.

That audiovisual work and short films are shot by Paulo Azevedo, a gentle bespectacled filmmaker I find at the pavilion's in-house restaurant.

He confirms that the pavilion will be a permanent fixture once the Expo closes on March 31.

“This has always been the goal because we still want to tell our stories and our culture,” he says.

“Our country is only 46 years old, even younger than the UAE, and after our civil war we are still picking up the pieces. We are ready to share with the world who we really are.”

It is a sentiment that resonates with both of us.

Azevedo fled the civil war in Angola, arriving in Portugal in the late 1980s aged 17, while my parents escaped the conflict in Eritrea to Abu Dhabi in 1979, where I was born two years later.

“To be showing my country in a positive light is a powerful thing,” he says.

“We are bringing awareness of Angola to other people and with the Expo we are learning about other countries and even finding some things in common.”

While the Angola and Egyptian pavilions are arguably the biggest from the continent, the smaller ones pack an experiential punch of their own.

Ethiopia, in the Opportunity District, has a serene coffee ceremony where I taste the rich brew the country is renowned for.

Botswana’s dimly lit interiors and cool temperatures are spa-like and offer a moment of convalescence after a day walking in the blazing sunshine.

trader

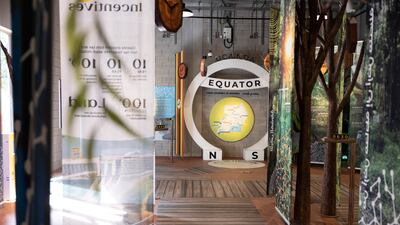

This is just as well, because the Tanzania pavilion, a few doors down in the Mobility District, is information overload.

The interior walls are filled with essays on the history of the East African country, from its founding president Julius Nyerere to its DAR Rapid Transit bus network, complete with local bus routes.

In the corner is a jewellery booth that could have come from Deira’s Gold Souq, selling all sorts of Tanzanian gemstones.

It is all a bit too much for me, so I venture on a longer walk across the Expo site until I find myself at the Lesotho Pavilion in the Sustainability District.

There you'll find Tamila Hushe, who was only a baby when Expo opened its doors in October, as she lay in her cot beside mother Emma’s souvenir stand.

Now Tamila sits snug in a baby sling on mum's back, while Emma conducts business.

“This girl has grown up in the Expo and took her first steps right here in the pavilion,” Emma says.

“This was important for me because I want her to learn about the world from a young age and this is the perfect opportunity. She has already made so many friends.”

Emma is a veteran of Expos, having represented her southern African country in the past two world's fairs, starting in Shanghai in 2010.

I ask if she experiences the same fatigue when people ask where exactly she is from.

“People don’t know because the world is a big place,” she says.

“I have met people in Africa and China who never even left their provinces, let alone the country.

“So we should tell them about our experiences because it helps us get close and know each other better.”