Abu Dhabi is to begin piloting fully electric buses with a view to rolling them out across its transport network late next year.

The green buses will be introduced gradually, but will eventually replace all diesel and other polluting vehicles of their kind, including school buses.

The companies behind the project said there are also plans to trial electric cars, vans and lorries.

The battery technology for the vehicles has been successfully tested in the UAE, coping with the challenges posed by the country’s extreme summer heat.

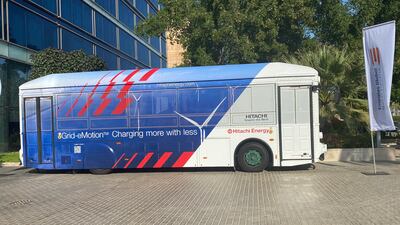

The new buses, which have been fitted with Abu Dhabi number plates and are ready to go, were displayed at a launch event in the capital on Wednesday.

The scheme is being run by a tie-up between Emirates Global Motor Electric, which is part of Al Fahim Group, Hitachi Energy, an expert in power grids, and battery manufacturer Yinlong Energy.

School transport to lead the way

Abby Thomas, the director of sales and marketing at Yinlong, said the decision over when and where to run the trial will be made by authorities.

But school buses could be first.

“That is the prime objective, because of the emissions,” he said.

“I think schools are important, because at the end of the day these kids are breathing in these fumes.”

The bus batteries can be fully charged in less than 20 minutes, said Mr Thomas.

“We have already completed two years of testing. Now we are getting into the roll-in phase of how we can talk to different operators in different regions.

“Our charging stations are already installed in the Department of Transport.

“We want to make sure we are ready for Cop28, and expanding the range into commercial trucks and vans,” he added.

Hany Tawfik, the head of Emirates Global Motor Electric and Emirates Global Industries, said they will be able to run fleets comprising hundreds of buses with its compact, fast and extensive charging network.

“We are proud to say these buses will be rolled out in the UAE next year,” he added.

The companies have designed smaller buses for schools and airport shuttles.

Bilal Alribi, general manager of Al Fahim Commercial Vehicles, said the smart charging system would allow the company to maximise its operations.

“E-mobility is the future of transportation and we feel privileged to be part of this journey towards a more sustainable future.”

UAE leading sustainability drive

Last month, Dubai announced it was to launch its own trial of two electric buses.

The Volvo 7900 vehicles will operate on designated paths in both directions between La Mer South, King Salman bin Abdul Aziz Street and Al Sufouh tram station.

The Roads and Transport Authority joined forces with Volvo Bus Company, Dubai Electricity and Water Authority, Meraas Real Estate, and ABB Group - a leader in the electric bus charging industry - for the eco-friendly initiative.

"The step reflects RTA’s efforts to provide sustainable and environmentally friendly mass transit means," Dubai Media Office said.