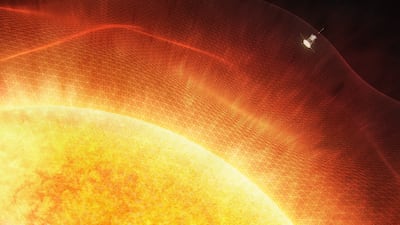

A Nasa spacecraft has ‘touched’ the sun for the first time.

The Parker Solar Probe flew through the sun's upper atmosphere to sample particles and magnetic fields.

This is the first time a spacecraft has entered the atmosphere of the Sun, known as the corona, where temperatures exceed one million degrees.

The probe was launched in 2018 to explore the mysteries of the Sun and get closer to it than any previous spacecraft.

"Parker Solar Probe ‘touching the Sun’ is a monumental moment for solar science and a truly remarkable feat," Thomas Zurbuchen, the associate administrator for the science mission directorate at Nasa headquarters, said.

"Not only does this milestone provide us with deeper insights into our Sun's evolution and it's impacts on our solar system, but everything we learn about our own star also teaches us more about stars in the rest of the universe.”

The findings have been published in the Physical Review Letters.

What did it capture?

After spending hours making several flybys in and out of the corona, the solar probe made new discoveries that other spacecraft were too far away to see.

These include studying the solar wind – the flow of particles from the Sun that can influence planets in the Solar System, including Earth.

“Flying so close to the Sun, Parker Solar Probe now senses conditions in the magnetically dominated layer of the solar atmosphere – the corona – that we never could before,” Nour Raouafi, the Parker project scientist at the Johns Hopkins Applied Physics Laboratory, said.

“We see evidence of being in the corona in magnetic field data, solar wind data, and visually in images. We can actually see the spacecraft flying through coronal structures that can be observed during a total solar eclipse.”

Through the flybys, Parker was also able to solve the mystery of where the Alfven critical surface lies, which is a point in space that marks the end of the solar atmosphere and beginning of the solar wind.

Solar material is bound to the Sun by its gravity and magnetic forces, but rising heat and pressure push the material away from the Sun to a point where these forces are too weak to contain it.

For decades, scientists wanted to know where exactly in space that point was.

The discovery has also helped prove that the Alfven critical surface is not shaped like a smooth ball, instead it has spikes and valleys that wrinkle the surface.

It flew into the eye of the storm

At one point, the spacecraft flew about 10.46 million kilometres from the Sun’s surface, where it was able to observe a feature in the corona known as a pseudostreamer – bright and massive structures that rise above the Sun’s surface and are visible from Earth during solar eclipses.

Nasa said passing through the pseudostreamer was like flying into the eye of a storm.

“Inside the pseudostreamer, the conditions quieted, particles slowed, and number of switchbacks dropped – a dramatic change from the busy barrage of particles the spacecraft usually encounters in the solar wind,” the space agency said.

The magnetic fields in the region were so strong that they controlled the movement of particles there.

Parker will continue flying closer to the Sun and possibly reaching as close as 6.1 million kilometres from the surface.

The next flyby is expected to take place in January and would probably bring Parker through the corona again.