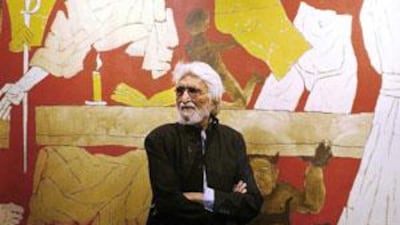

DUBAI // The renowned Indian painter Maqbool Fida Husain, who has lived in self-imposed exile in Dubai for four years, might leave the country after being offered Qatari citizenship. Husain, who was attacked by right-wing Hindus over paintings of goddesses which they considered offensive, made the announcement to The Hindu, an Indian newspaper. The paper said the nonagenarian artist did not ask for the nationality but was granted it by the rulers of Qatar.

"I, the Indian origin painter MF Husain at 95, have been honoured by Qatari nationality," he said in a black and white line drawing released to the paper. Whether or not he would accept the citizenship was not clear yesterday. Since Indians cannot have dual citizenship, Mr Husain would lose his Indian nationality if he were to accept the offer. Husain, dubbed by critics "the Picasso of India", left India in 2006 after charges were brought against him over a series of paintings that included the depiction of a naked woman, in the shape of India, kneeling. The Bharat Mata, or Mother India, paintings sparked death threats and protests by right-wing Hindus. Mobs attacked Husain's home in Mumbai.

Husain moved to Dubai and has been in exile, moving between the Emirates and Britain. The painter, whose work has sold for as much as US$1.6 million (Dh5.8m), has repeatedly expressed his desire to return to his country. In September, the Supreme Court of India acquitted Husain of insulting the Hindu faith. However, he has remained in self-imposed exile, wanting to be sure that he was cleared of all charges before returning home.

In November, he told The National that he would take the first flight to India if the home minister called and assured him that he would be safe and all court cases against him were closed. The large Indian fan base of the painter, which includes both Muslims and Hindus, have been imploring the government to arrange a dignified return for one of the nation's finest living artists. pmenon@thenational.ae