ABU DHABI // Non-government organisations from Germany, Britain and the United States are competing for top spot in the Zayed Future Energy Prize this year.

The winner in this category, one of five, will be awarded US$1.5 million (Dh5.5m) at a ceremony in Abu Dhabi this month.

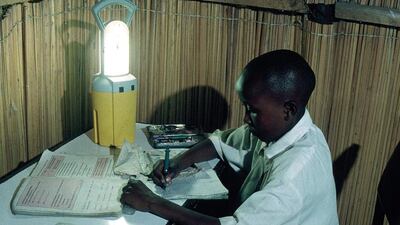

Among the three finalists is a British organisation that seeks to provide sustainable household energy for cooking and lighting to poor people in rural areas.

Founded by an economist and philosopher, Fritz Schumacher, who is most famous for his 1973 book Small is Beautiful, the organisation aims to achieve technology justice.

“In our world, economic growth and technological advancements offer little for the two billion people living in abject poverty,” said Simon Trace, chief executive of Practical Action.

“There are still 1.4 billion people in the world with no access to electricity while almost half the world’s population still cooks over open fires.

“Technological innovation is focused on meeting the wants of rich consumers rather than the most basic needs of poor people in the developing world.”

Most of Practical Action’s funds come from government grants, as well as European Union and United Nations agencies, with an estimated £3.6m (Dh21.7m) spent on its energy-access programme last year.

Should the organisation win, the funds would equate to about a quarter of the programme, said Mr Trace.

“These funds would allow Practical Action to significantly expand the influence and impact of our work, and directly improve energy access for over 60,000 people living in some of the world’s poorest countries,” he said.

Accelerating the adoption of renewable energy is also a priority for the World Resources Institute (WRI), a US organisation that develops evaluation tools for the industry in collaboration with governments, businesses and civil society.

The organisation has a staff of 350 in offices across the US, China, India, Brazil and Europe.

“In practical terms, the prize would provide a valuable source of flexible funding, which would allow us to more quickly implement and expand our clean energy work, and build our capacity to support WRI’s global presence,” said Dr Andrew Steer, president and chief executive.

The organisation is linking up with businesses and power suppliers in its Green Power Market Development Group, which aims to increase adoption of renewable energy.

“We have had success with this approach in the United States and we are now active in India,” said Dr Steer.

“This is a model that is working well. If we were to win the prize we would immediately expand the programme to some countries where we have already been requested to work by governments and the private sector.”

South Africa is one country where the initiative could continue, Dr Steer said.

Also among the finalists is Europe’s largest solar-energy research body, the Fraunhofer Institute for Solar Energy Systems.

Prof Eicke Weber, director of the German institute, said the organisation “strives to develop a holistic model for the electricity and heat sector in a future energy system with a dominant contribution of renewable energies”.

Should it win, the funding would go towards its research budget, Prof Weber said.

“The prize fund would be invested in this project in order to create an exemplary tool for the smooth and cost-efficient transition of our current energy system into a sustainable one,” he said.

“Furthermore, the fostering of young academic talent and junior staff members is an important priority where allocations are always needed.”

The award ceremony is taking place on January 20 as part of Abu Dhabi Sustainability Week.

vtodorova@thenational.ae