The number of Emiratis working in the private sector increased by 11 per cent in Q1 2023 over 2022, the Ministry of Human Resources and Emiratisation revealed on Wednesday.

The numbers were not disclosed but by the end of last year, more than 50,000 Emiratis were employed in private companies, according to data published on the ministry's website.

Of these, 28,700 people joined after the Nafis programme was rolled out in 2022 as employers were directed to have two per cent of roles taken up by Emiratis by the end of the year.

The number of private companies that employed Emiratis increased by more than 13 per cent and 8,897 companies reached the two per cent Emiratisation target by the end of 2022.

The ministry also said on Twitter that more than 5,000 Emiratis benefited from career counselling in the first three months of the year.

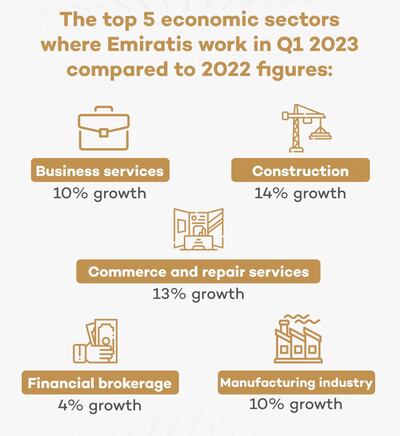

According to the ministry's tweet, Emiratis working in the private sector are mostly employed in business services, construction, commerce and repair services, financial brokerage and manufacturing.

Under the Nafis programme, private sector companies with at least 50 employees must ensure three per cent of their workforce is made up of Emiratis by July 1.

Employers in the UAE are expected to meet a four per cent target by the end of the year as part of the government’s Emiratisation initiative.

The Emirati employment rate is to increase to six per cent in 2024, eight per cent in 2025 and 10 per cent in 2026.

Those end-of-year goals remain in place, but private businesses must now make sure they reach those targets with an increase of one per cent every six months.

The measures apply to skilled positions and companies in free zones are exempt. They are, however, encouraged to participate in the scheme.

On March 12, the government also introduced a new initiative called the Industrialist Programme that is designed to increase Emiratisation in the industrial sector, upskill national cadres and help them gain skilled jobs.