Independence Day 1962. As millions of Americans enjoy the July 4 holiday, on the other side of the world another celebration is taking place.

This is independence of a different kind. The first shipment of oil is leaving Abu Dhabi, and with it the promise of better times ahead.

As with Americans, for Abu Dhabi the day also represents freedom. In this case it is freedom from poverty, from disease, and an end to the lack of basic necessities including health care, education, clean water, sanitation, permanent housing, even roads.

All these things will come very quickly with the export and sale of oil. Even that first modest shipment was worth nearly $500,000, or at today’s prices more than $3 million.

It is only four years since oil was discovered in March 1958, at the Umm Shaif off-shore field near Das Island.

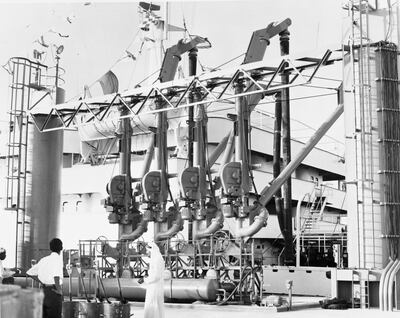

Now the island is the heart Abu Dhabi’s oil production. At mid-afternoon on July 4, two tugs secure the bow and stern lines of the British Signal, delicately manoeuvring the 35,000-tonne ship away from the loading platform until the BP tanker can proceed into the Arabian Gulf under her own power.

Overhead, a company photographer leans out of a clattering helicopter, capturing the moment for the history books.

The British Signal carries 254,544 barrels of oil, then worth $458,197 on the international markets. A barrel of oil at the time was worth $1.80. In 1962, Abu Dhabi oil production, soon to be joined by the huge Murban Bab onshore field, reached 10.5 million barrels a year.

Today that total can be produced in a single day, while oil is currently valued at $117 a barrel. It is a bounty that has brought life-changing benefits to the people of the UAE. From one of the poorer countries in the world in 1960, it is now one of the wealthiest.

Memories of that historic first voyage flooded back for John Small, then a 20-year-old assistant cook on the ship.

Like everyone on board, Small knew it was a special day. For starters, there were the trays of canapes Small had to prepare for the official party, as the ship hosted members of the Royal Family and visiting oil company bigwigs, flown to the port at Das Island.

For the 50th anniversary, Small, now retired from sea and living in southern England, recalled the ship's arrival to The National.

"We knew it was big day. As we approached there was a fanfare with tugs pumping fountains of water and the ship was decked with flags."

He remembers that the weather was poor: "There was a sandstorm and we couldn't really see the island."

Small had sailed up the Arabian Gulf before, loading oil from Kuwait. This time he joined the British Signal when she was laid up at Tilbury dry dock in London. He still has his papers, stamped June 2, 1962.

From Britain, the tanker sailed east through the Mediterranean, passing through the Suez Canal before turning north-east into the Arabian Sea. She arrived at Das and connected to the flow lines once her ballast had been discharged.

Normally a ship of this size would load and depart in 16 hours, but because this was a VIP occasion, the sailing was delayed.

After the formalities — which included a crate of ale for each crewman — the tanker set sail at 2.45pm, records show.

BP logs say the tanker was bound for its refinery in Aden. In its review of the year for 1962, the UK Institute of Petroleum, now known as the Energy Institute, also lists Aden as the destination.

John Small remembers otherwise. Ships of the size of the British Signal did not transport oil to Aden, he insists. Besides, he has no recollection of arriving at the port.

Normally, Small says, these tankers would have taken a full cargo of oil back to another BP refinery on the Isle of Grain, at the entrance to the River Medway on the south coast of England.

But after a four-week journey that took almost exactly the same time as the outward trip, the British Signal instead docked at Glasgow in Scotland. On August 4, 1962, his discharge papers were stamped and signed in Scotland, with his conduct marked "very good".

The voyage of the British Signal was the first of many. By 1970, annual production had exceeded 250 million barrels, while the largest oil supertankers today can ship around 2 million barrels in a single trip.

Oil still sustains the economy, but increasingly the search is for new, renewable sources of energy and diversified industries for a stronger, sustainable economy.

“In 50 years, when we might have the last barrel of oil, the question is: when it is shipped abroad, will we be sad?” the President, Sheikh Mohamed asked during a speech in 2015, adding the reply: “If we are investing today in the right sectors, I can tell you we will celebrate at that moment.”

As the UAE marks the 60th anniversary of the sailing of the British Signal, the country is beginning a new voyage on a fresh course.