When Tyson Fury lifted his giant frame off the canvas, like a regenerating corpse in a zombie film, for a second time in his thrilling title fight against Deontay Wilder last December, the heavyweight boxing world shook on its axis.

After a trademark performance from the British underdog, bewildering his opponent with quick footwork and evasive counter-punching, he was floored by the American in the ninth and then, in the 12th and final round, was viciously dropped again. The remarkable contest looked over.

But somehow Fury – who had struggled with mental health issues and substance abuse in the dark years following his famous victory over Wladimir Klitschko, to become world champion in 2015 – regained his senses to see out the final couple of minutes without any problems.

The crowd in at the Staples Center Los Angeles roared in amazement. He may have been seconds from defeat, but Fury had dominated the contest as a whole and Wilder’s WBC crown was surely his. However, two out the three judges saw it differently with one, clearly watching a different fight to the rest of the world, giving it 115-111 to Wilder. One called it a draw, with the other going for Fury 114-112.

“The Gypsy King has returned,” Fury said after the bout. “We’re on away soil, I got knocked down twice, but I still believe I won that fight. The world knows I won the fight.”

Talk of a rematch was immediate and, with IBF, WBA and WBO champion Anthony Joshua waiting the wings desperate to be part of the action, the stage was set for potentially the most exciting era of heavyweight boxing since the likes of Mike Tyson, Lennox Lewis and Evander Holyfield battled for supremacy nearly 20 years ago.

But, as is the way with professional boxing at the highest level, politics and business soon got in the way and now, four months after that enthralling night in LA, several large spanners have been thrown into the works.

All three fighters – Fury, Wilder and Joshua – have signed up to fight, sadly none of them with each other. And hopes of those bouts taking place took a major blow in February when 30-year-old Fury signed a US$100 million (Dh367.3m) deal with American broadcaster ESPN to cover his next five fights, while remaining on BT Sport in the UK.

This was going to make future negotiations, a draining process at the best of times for fights of this magnitude, incredibly problematic as Wilder works with rival American broadcasters Showtime, while Joshua is signed with US streaming service DAZN and Sky Sports in the UK.

First, though, all three unbeaten boxers must negotiate their way past their next opponents.

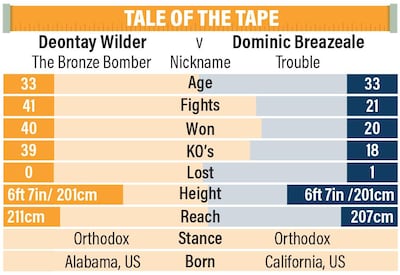

Wilder, 33, is back in the ring first, taking on fellow American and mandatory challenger Dominic Breazeale in New York on May 18. Breazeale, also 33, has lost only once in 22 fights but that defeat was a brutal one when he was knocked out in the seventh round by Joshua in 2016.

Breazeale said last year that that beating in London “is going to haunt me forever” but insists he is a “different fighter now” and ready to become world champion.

For Wilder – with 40 wins, 39 of them via knockouts – the aim is simple: “I want to get him out of the way. I’m about to smash this fly.”

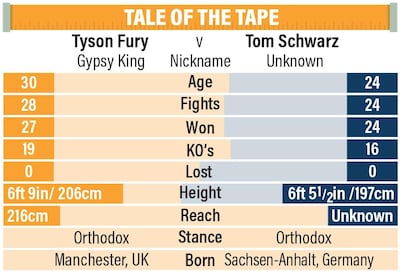

Fury, meanwhile, has taken on the easiest fight, on paper anyway. Tom Schwarz might be unbeaten in 24 fights but he has only fought outside of his native Germany twice and never faced someone of Fury’s class.

Fury defended the contest on June 15, calling Schwarz “unbeaten, young, fresh and ambitious” but Joshua’s promoter, Eddie Hearn, called it a “dreadful fight” and an “easy touch".

Even Frank Warren, who looks after the Manchester-born fighter, conceded he was “very disappointed” with the Las Vegas fight, saying that ESPN and co-promoters Top Rank had demanded a warm-up match and “exposure” in the US for their new signing.

Fury, though, clearly still has his eyes on the prize. "Me and Wilder have to have this rematch. I have to take care of Schwarz, he has to take care of Breazeale and then I say we get it on."

His trainer, Ben Davison, hinted last month that a Joshua fight at the end of the year was more likely, “[but] don’t hold me to it”.

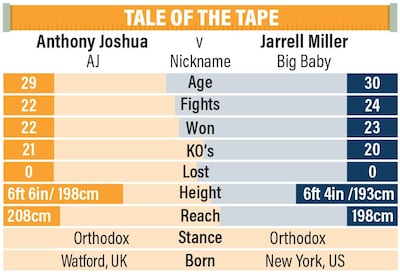

Joshua, meanwhile, has arguably taken on the biggest risk. He fights outside of the UK for the first time in his pro career – consisting of 22 wins, with 21 KOs – against unbeaten Jarrell Miller at the iconic boxing venue of Madison Square Garden on June 1, on the American’s home turf of New York.

Jarrell, known as Big Baby, says the Briton has made a “big mistake” in taking the fight and even Joshua is wary of what he called the “banana skin factor” that could derail his hopes of taking on either Fury and Wilder in the near future.

He had booked out Wembley Stadium to fight with Wilder this month, but those hopes were dashed by Fury’s stunning return to the top.

“Things happen, boxing politics,” Joshua, 29, conceded. “We had to branch out and look for other options.”

So for now, the big beasts continue to circle each other and the world waits with baited breath in the hope that “boxing politics” does not stop an era-defining series of fights from taking place.

The final word on that, goes to Wilder: “We need to see one champion, one face, one name. It takes a lot of people and a lot of cooperation to make that happen.”