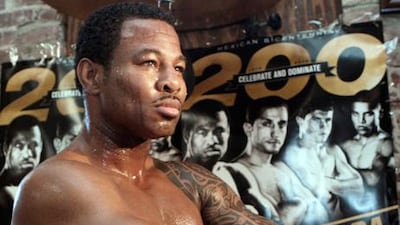

Five-time former world champion "Sugar" Shane Mosley has called time on his boxing career - after never suffering a knockout.

The 40-year-old, who famously beat Oscar De La Hoya in 2000 for the welterweight title, now plans to became a trainer to his 21-year-old son.

It brings to the end a remarkable 19-year in-ring career that saw him win five world titles in three weight classes.

Mosley's announcement comes just weeks after he lost a unanimous decision to junior middleweight champ Saul "Canelo" Alvarez of Mexico.

"Good morning everybody. Just want to thank you for showing me so much love," Mosley wrote on Twitter.

"Had a great career and loved every moment of it, win, lose or draw."

Mosley, from California, is one of the few boxers of his era to have never been knocked out.

He finished with a 46-8-1 record, but was 0-3-1 over his last four fights, including a loss to Manny Pacquiao last May.

"I'm going into the promotional world. I'm training my son," he told ESPN after his announcement.

"It was a helluva career. I'm happy for all the great memories and all the great fighters that I fought. Now it's time give back. I'm ready to train my son full-time now,"

sports@thenational.ae

Follow us