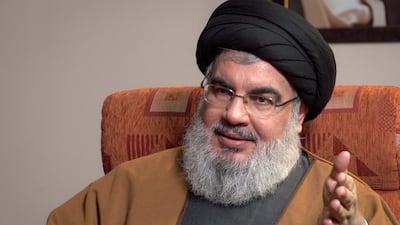

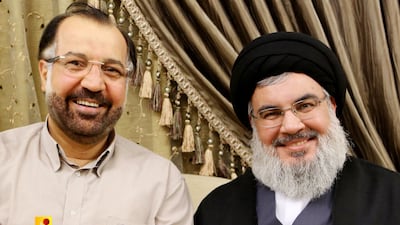

Hassan Nasrallah, the leader of Lebanon’s Iran-backed armed group Hezbollah, was killed in an Israeli attack on Hezbollah’s command centre on Friday night. His death was confirmed by the group hours after it was announced by an Israeli army spokesman. He was 64 years old.

Branded a terrorist by the United States and many of its allies, Nasrallah served as the third secretary general of Hezbollah, which emerged in Lebanon in the early 1980s.

Under his leadership since 1992, following Israel’s assassination of his predecessor, Abbas Al Musawi, Hezbollah has grown to become the most powerful group in the country.

Born in 1960 in Beirut to a religious family from the southern village of Bazouriyeh, Nasrallah left Lebanon in the 1970s to pursue Islamic studies in Najaf, Iraq, before returning to Beirut to join Hezbollah following the Israeli invasion of 1982. He later travelled to Iran where he spent some years before returning to Lebanon in the early 1990s to lead the group.

During his tenure, Hezbollah significantly expanded its arsenal of missiles and modernised its military capabilities, forcing Israel to withdraw its forces from south Lebanon in 2000 after two decades of occupation.

In 2005, Hezbollah came under intense pressure as Syria, one of the party’s staunchest allies, withdrew its troops from Lebanon following the assassination of Prime Minister Rafic Hariri, whose killing was widely blamed on Damascus at the time. Fifteen years later, a UN-backed court convicted a Hezbollah member in absentia of participating in the murder.

A year after the assassination, Nasrallah led Hezbollah in a devastating 34-day war with Israel that ended in stalemate. The war started after Hezbollah fighters crossed into Israel and attacked an army convoy patrolling the border, killing three soldiers and taking two back into Lebanon. The goal of the attack was to pressure Israel to release Lebanese detainees in Israeli prisons.

The war, which inflicted heavy material losses on Lebanon, killed more than 1,200 Lebanese – mostly civilians – and about 44 Israeli civilians and 121 soldiers. It drew strong criticism from Nasrallah’s local political rivals who accused Hezbollah of dragging the country into the regional conflict pitting Iran against Israel.

Nasrallah’s reign also marked the first time Hezbollah publicly acknowledged taking part in armed conflicts beyond Lebanon’s borders.

Following the outbreak of the civil war in Syria, Nasrallah announced in May 2013 that his fighters had joined Syrian President Bashar Assad’s forces in their battle against anti-regime forces and extremist groups.

Hezbollah’s continued presence in Syria has sparked domestic criticism of the Iran-backed party for plunging Lebanon into regional conflicts and undermining confidence in its economy.

As the worst economic crisis to grip Lebanon in decades unfolded in 2019, many blamed Hezbollah for the country’s financial woes.

The party’s political foes argue that Hezbollah’s role in Syria and its grip on the government have undermined Lebanon’s ties with Gulf states, which have long provided financial support to the Mediterranean nation.