This year's G7 summit is taking place in the picturesque, highly secure and now familiar hotel Schloss Elmau, in Germany. It is the second time the meeting has been held there – the last in 2015.

While sombre international affairs are the focus, it is not just the content, but also the manner in which these issues are discussed that makes the event distinct. It is the most personal meeting its leaders have in the calendar, with limited, controlled media access and only the most important advisers present. Last year, pictures emerged of its attendees eating ice cream with little social distancing on a beach in the British county of Cornwall. More than just a sign of closeness, it was a marker that the world was beginning to reopen after the worst of Covid-19.

In 2022, the location might be the same as 2015, but the world is not, and not just due to the pandemic. Up for discussion this year is the conflict in Ukraine and the vast international fallout from it, as well as other strategic issues confronting the group.

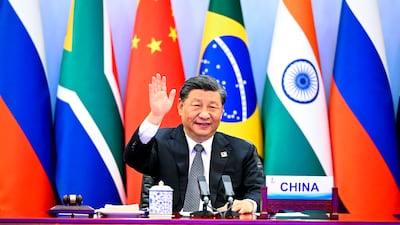

Furthermore, the G7 is not the only high-level multilateral event to take place this month. Brics, a summit involving Brazil, Russia, India, China and South Africa – countries that make up more than 40 per cent of the world's population – took place last week, under the theme: "Foster High-quality Brics Partnership, Usher in a New Era for Global Development".

Strong partnerships will be particularly important for Russian President Vladimir Putin. His country's invasion of Ukraine has put relations with the West at a historic low, ushering in unprecedented sanctions and what Russia claims to be a "proxy war" with Nato. Strong ties with countries such as India and China will be key to keeping the Russian economy afloat.

Mr Putin will be closely watching the coming Nato summit, which begins in Madrid on Tuesday and is the 32nd since the alliance’s establishment in 1949. In the run-up to the meeting, some of the members' leaders have already pushed for even more support to Ukraine, much to the consternation of Moscow. British Prime Minister Boris Johnson has told allies it would be a “disaster” to pressure Ukraine into accepting a “bad peace” deal. Ukrainian President Volodymyr Zelenskyy is expected to say the same in an address. Nato will also discuss the prospect of Sweden and Finland joining, a hugely important drive given the countries' strategic value, history of neutrality and Turkey's opposition to the move, due to the Nordic states' perceived tolerance of what Ankara describes as Kurdish separatists and terrorists. Nato Secretary General Jens Stoltenberg also said that "for the first time, we will address China and the challenges it poses to our interests, security and values".

On the international diplomatic stage, June might seem like an adversarial month. But however tense the situation might be, it is important to remember that all three of these events have at their heart some form of diplomacy and, at least in the eyes of members, a desire to make the world safer. All the above nations will need to co-operate if they are to deal with today's unprecedented difficulties, none more pressing than looming food and economic crises, which would affect the Middle East particularly. Whether it be finding a diplomatic solution to the war in Ukraine, or dialling down tensions in the South China Sea, such meetings are among the few international means left to promote harmony, not strife.