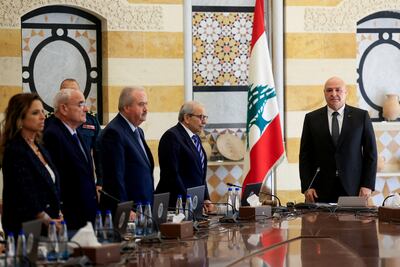

Last Friday, the Lebanese army presented a plan to the government of Prime Minister Nawaf Salam to implement the government’s decision taken a month earlier to secure a monopoly over weapons. This policy priority has been opposed by Hezbollah.

While the plan hasn’t been made public, it avoided setting a timetable for disarmament in order to avoid a confrontation with Hezbollah. Instead, it reportedly has been subdivided into phases. Its implementation, armed forces commander Gen Rodolphe Haykal has said, will proceed according to the institution’s “available capacities”.

When the government initially approved the decision to impose a monopoly over weapons, it had set an end-of-year deadline for disarmament of all militias. This deadline corresponded more or less to the one the US envoy to Lebanon, Tom Barrack, had presented to the Lebanese in a plan formulated by the Americans.

However, on his last visit to Beirut in August – in which he was accompanied by his predecessor, Morgan Ortagus, and senators Lindsey Graham and Jeanne Shaheen, as well as representative Joe Wilson – the context changed. The Lebanese had expected Mr Barrack to obtain Israeli buy-in for his plan, in exchange for Lebanon’s approval of its disarmament commitment. They were looking for a reduction in Israel’s attacks and withdrawal from some areas of the south.

The Lebanese intention was that a step-by-step process would be put in place, whereby for every Lebanese step, Israel would make a concession of its own. In this way, positive momentum would build up and the government would have more leverage over Hezbollah to surrender its weapons.

Yet when Mr Barrack met Speaker of Parliament Nabih Berri, a key interlocutor with Hezbollah, he reportedly let him know that Israel had not agreed to such a process. Mr Berri told Asharq Al Awsatthat the Americans “came to us with the opposite of what they promised”, an apparent reference to earlier remarks from Mr Barrack that a step-by-step mechanism was possible.

Not long afterwards, Lebanese Deputy Prime Minister Tarek Mitri appeared on a talk show to say that the government no longer felt bound by the Barrack plan, which he deemed “valueless”, because Israel had not made any concessions, even if Lebanon remained committed to fulfilling a monopoly over weapons. This meant that Lebanon would no longer abide by the envoy’s tight timetable.

It did not help matters that during Mr Barrack’s visit, US officials only added to the confusion when it came to Israel’s intentions. Ms Ortagus said: “Israel is ready to move forward step by step with the government, now everything depends on deeds, not words. We will respond to every measure taken by the government with an action from Israel.” This implied that Israel had actually agreed to a step-by-step process, which Mr Berri and Mr Mitri subsequently denied.

Yet in a news conference, Mr Graham set a harsher tone. He stated: “[D]on’t ask me any questions about what Israel is going to do until you disarm Hezbollah. If you disarm Hezbollah, we’ll have a good conversation. If you don’t, it’s a meaningless conversation.” Mr Graham is very close to the Israelis, and his remarks appeared to stress that no step-by-step measures were in the works.

Who was telling the truth? It remains unclear. However, if the current deadlock prevails – with Hezbollah continuing to refuse to disarm and the government set on disarming all militias – there are two potential outcomes.

The first is that the Lebanese army will be pushed by the Americans to forcibly disarm Hezbollah. Mr Graham hinted at this in Tel Aviv, a day after his trip to Lebanon. “If we cannot reach a peaceful disarmament solution for Hezbollah, then we need to look at plan B. Plan B is disarming Hezbollah by military force,” the senator declared.

However, Lebanese officials will want to avoid this at all costs. They are right to do so, as such an operation would probably get bogged down, lead to death and destruction, and alienate the Shiite community. Nor is it even clear that the army has the capacity to successfully carry through such a scheme.

The alternative is for Lebanon to advance more slowly and engage with Hezbollah in a dialogue over disarmament. Simultaneously, the army can increase its interventions to limit the group’s margin of manoeuvre, uncover arms caches and limit Hezbollah’s ability to transport weapons, in a process avoiding a head-on collision. This seems to be the preference in Beirut.

Still, the US and Israel probably want a process that is much more decisive and rapid, leaving the Lebanese with one of two bad options: either to embark on a domestic conflict that could morph into civil war; or face the likelihood of a new Israeli onslaught against Lebanon. Yet such a stark choice could have been avoided had the administration of US President Donald Trump shown diplomatic imagination.

Yet when it comes to Lebanon, neither the Trump administration nor the preceding Joe Biden administration has shown any distance with Israel. It is the Israelis who are calling the shots. When Mr Barrack tried to do so on prior trips, adopting positions not aligned with Israel on Hezbollah, pro-Israel think tanks in Washington produced articles demanding his resignation.

We are not far from a point where the US may shift towards encouraging Lebanon’s government to use force against Hezbollah. This is worrisome, when a far more sensible path is to return to a step-by-step process that could facilitate a political outcome. However, the US must be willing to push for Israeli flexibility first.