Live updates: Follow the latest on Israel-Gaza

Two Republican senators have sent a letter to President Joe Biden demanding answers about reports that his administration has blocked an ammunition transfer to Israel, emphasising the need to support Washington's long-time ally and raising concerns about transparency.

“We are deeply concerned that your administration failed to notify Congress about this decision,” Joni Ernst, who serves on the Armed Services Committee, and Ted Budd said in the letter, obtained by The National.

“Just one month ago, Congress passed a national security supplemental to provide military assistance to Israel.

“If these reports are true, then you have once again broken your promise to an American ally.”

The White House has declined to answer questions about reports that surfaced at the weekend saying it had withheld the aid.

A small but growing number of Mr Biden's Democrats have raised concerns about whether US aid is being used to violate international law amid the Israel-Gaza war, which has killed about 34,800 Palestinians since October 7, according to local health authorities.

Last week, Washington accused five Israeli military units of committing “gross violations of human rights” in the occupied West Bank before October 7, though it has avoided addressing concerns about units' conduct in Gaza.

Later on Tuesday, Representative Mike McCaul, the Republican chairman of the House Foreign Affairs, said: “The many reports that the administration is delaying sending Israel weapon components to improve the accuracy of aeroplane-dropped bombs is very concerning.

“I'm looking into these allegations and expect the administration to be transparent with our committee.”

In their letter, Ms Ernst and Mr Budd demanded Mr Biden tell Congress what ammunition his administration has withheld from Israel, whether it had been approved by Congress and why politicians were not notified.

“We must give Israel the arms it needs to fight the Hamas terrorists that continue to hold Americans hostage,” the senators said. “We call on your administration to immediately restart the weapons shipments to Israel today.”

Ms Ernst has been at the forefront of lobbying for support for Israel in Congress and has worked closely with hostage families since the October 7 Hamas attacks, in which about 1,200 people were killed and about 250 taken into Gaza.

Republican Speaker of the House Mike Johnson, meanwhile, on Tuesday said “it looks to be true that President Biden is clearly trying to placate the pro-Hamas element of his party – there's no other explanation for that”.

Mr Johnson added that the Biden administration assured him personally “as recently as Friday” that there would be “no delay” in delivering assistance to Israel – a battle that was hard-fought in Congress amid chaotic Republican infighting linked to domestic politics.

“This is not the will of Congress. This is an underhanded attempt to withhold aid without facing accountability. It's undermining what Congress intended,” Mr Johnson said.

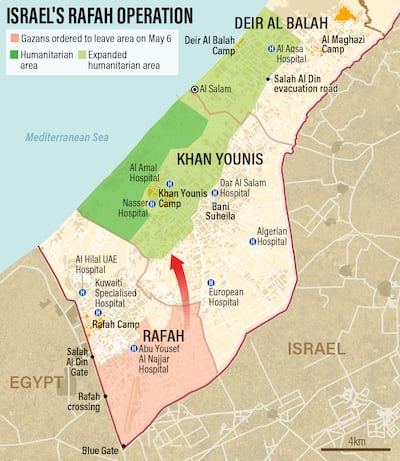

The pushback also comes as Israel moves forward with a military operation in Rafah, which both the Biden administration and more centrist members of his Democratic Party have warned against.

Chris Coons, a Democratic senator and ally of Mr Biden, endorsed Washington placing conditions on aid to Israel “if they continue with large-scale military operations in Rafah without making any provisions for civilians”.