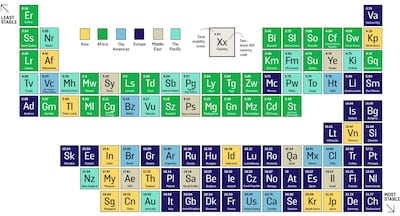

There are better ways to rank nations than according to whether they are simply wealthy or democratic, a political scientist who has devised a new index has said.

Parag Khanna, who recently unveiled the Periodic Table of States, said that his method offered a more scientific guide to how stable countries were.

Speaking to The National, Dr Khanna said that stability, which the index calculates by combining strength with so-called "stateness”, was the goal of all nations regardless of their political system.

The new index has placed the UAE and other Gulf countries among the top performers, surpassing some western nations.

Saudi Arabia ranks 24th out of 196 nations, while the UAE is 27th, ahead of New Zealand, which is ranked 29th and Iceland, which is 50th.

A new approach to measuring stability

Dr Khanna, chief executive of AlphaGeo, an AI analytics platform and the author of several books, said that other indices focusing on whether countries were democratic or non-democratic, or rich or poor, could be “vague and generalised”.

“I grew quite frustrated by those oversimplifications,” said Dr Khanna, who was born in India but spent part of his childhood living in Abu Dhabi.

“I really felt that we needed a more rigorous, scientific, technical approach to measuring the quality of states.”

Every nation, he said, “wanted to be a better version of itself”, so he created a dashboard that would allow a country to improve using what he said were objective indicators.

He said that all states wanted to be stable, but there was not a good answer to what a stable state was, so he included variables such as military capability, population size, territorial size, trade balance, sovereign assets and currency stability.

The second key measure, stateness, was not just a function, Dr Khanna said, of whether a country was democratic. The Periodic Table of States, he said, put “decidedly less” emphasis on democracy than some other indices.

He said that “far more important” were measures such as the quality of public institutions, the efficiency of public service delivery and the accountability of government. Rule of law, median income, food security, energy reliability, climate resilience and the quality of infrastructure also determine stateness.

“If a state scores well in all of these things, in strength and stateness, then in all likelihood it is quite stable,” Dr Khanna said. “Stability is the result, stability is the target, stability is what every state wants.”

He said that many nations, such as Kazakhstan, Singapore and Vietnam, ranked quite highly in the index even though they were not western-style democracies.

Why the UAE ranks highly

For the UAE, he said strong points were good governance, the level of development, connectivity, international influence and stability. Other plus points include levels of foreign direct investment, GDP and energy security.

In recent meetings with UAE officials, Dr Khanna said he highlighted areas that could be enhanced, including increased innovation, expanding overall economic diversification and growing the market capitalisation of the stock exchange.

Switzerland is ranked first in the index, followed by Germany, Japan, South Korea and Sweden. The top 10 also includes Canada, the US, France, Denmark and the UK. Other highly ranked nations include China (13th), Qatar (34th), India (43rd) and Kuwait (53rd).

Other analysts said that a main strength of the Gulf states was that they ensured that their citizens had a high standard of living.

“Healthcare is more or less for free, education is free, even tertiary education is mostly for free. They enjoy very high subsidies for fuel and water. The states provide them with a great infrastructure,” said Martin Beck, an associate of the German Institute for Global and Area Studies.

While there are other concerns, in the UAE there is “a high degree of support” for the country’s leaders, said Clive Jones, professor of regional security at the University of Durham in the UK.

Frederic Schneider, an economist and Gulf analyst, and former lecturer at the University of Birmingham in Dubai, said that even indices that combined many metrics were “still very constrained” if they produced a single figure.

An alternative, he said, was to have multiple indicators that were not put together into a single score. This might be preferable, he said, given countries’ different objectives.

“As a policymaker, you have different goals. You have different goals from the country next door. Also, you as a minister of education, for example, have a different objective than the ministry of defence. You have to pick the metrics that are most suitable,” Dr Schneider said.

Some goals, such as decoupling economies from hydrocarbon production, were specific to particular states, so might not be highlighted by a catch-all index.

He said, though, that stability – the metric focused on by the Periodic Table of States – was an important metric that many governments prioritised, although more than one metric was important at analysing good governance.