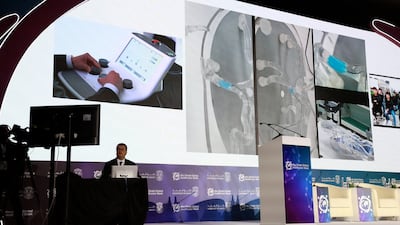

A glimpse into the future of health care was offered on Wednesday when a doctor in Abu Dhabi remotely simulated surgery on a stroke victim in Korea.

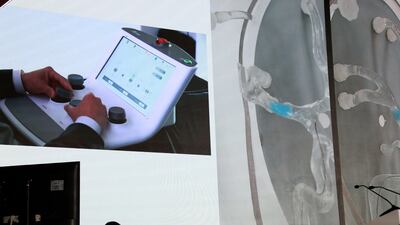

The procedure to remove a blood clot from the brain using a remote-controlled robotic system was demonstrated at Abu Dhabi Global Healthcare Week.

An audience watched the procedure on a big screen as Dr Vitor Mendes Pereira controlled robotic wires to simulate surgery 7,000km away, replicating the procedure to treat stroke victims.

chief executive of XCath

Dr Pereira, director of Endovascular Research and Innovation at St Michael’s Hospital in Toronto, Canada, said: “While it may be a few years until such technology is introduced, the potential is monumental and could save thousands of lives.

“This is a concept that we hope will become a reality soon. I confirmed that I can control a robotic arm 7,000km away.”

There were times, he said, during the procedure that he forgot he was so far away from the patient.

The procedure has the potential to revolutionise how stroke victims are treated, he added.

Growing number of stroke victims

Each year, 15 million people globally suffer a stroke, with five million of those dying as a result and a similar figure left permanently disabled, according to the most recent report from the World Health Organisation (WHO).

The number of stroke victims is only likely to increase due to the world's ageing population, the report warned.

Most stroke victims need urgent specialist treatment that is only available in certain hospitals, added Dr Pereira.

“If we can deploy the robotic arms into the hospitals that are close to where the patients are and save their transportation time, lives will be saved,” he said.

“When a patient has a stroke, every minute counts.”

The simulated surgery was completed in a matter of minutes on Wednesday, with Dr Pereira using a microcatheter to re-enact the procedure to remove a clot from a blood vessel in the brain.

The procedure to remove the clot is known as mechanical thrombectomy, a treatment that is not widely available.

“The majority of humanity does not have access to this treatment,” said Eduardo Fonseca, chief executive of XCath, the firm behind the technology.

“And even those that do, do not get there in time and the procedure is incredibly time-sensitive. So this brings together a problem that can be solved by endovascular telerobotics. ”

Worldwide household income losses due to premature death or disability from strokes is $576 billion, according to the most recent figures available from the World Stroke Organisation (WSO).

The same report said the number of people having strokes had increased by 70 per cent in the past three decades, while the number of people living with strokes worldwide has shot up by 85 per cent.

A person living in a low-income country was likely to have their first stroke when they were 15 years younger than their wealthier counterparts, the same study said.

Another expert said the procedure demonstrated on Wednesday is a vital step towards reducing the number of lives affected by strokes.

“This pioneering achievement is not just a first, but a crucial stepping stone towards regulatory and industry support, ultimately leading to widespread acceptance and adoption,” said Dr Fred Moll, founder of Intuitive Surgical, a company specialising in robotic surgery.

“In the field of endovascular care, particularly in stroke treatment where every minute counts, this technology holds transformative potential.”

The use of advanced technology was the theme of this week's healthcare conference in Abu Dhabi.

An AI-powered chest X-ray for tuberculosis (TB) was showcased by M42, a tech health firm based in the emirate.

The technology, which was tested at screening centres for visas in the emirate, was said to reduce radiologists' workloads by up to 80 per cent while not missing any cases of TB.