A 2.4km aerial track in Sharjah capable of transporting passengers in futuristic sky pods at speeds of up to 100kph has been unveiled for the first time.

Developed by uSky Transport, the pods that can carry 25 passengers at a time are on show at the $14 million Karat complex at Sharjah Research, Technology and Innovation Park (SRTIP).

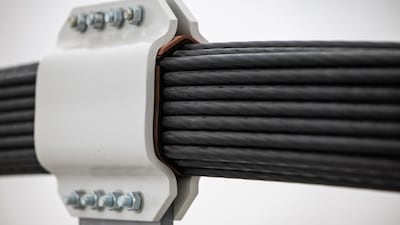

They move on cables made of extremely durable material.

The National was among the first to take a journey on the cutting-edge mode of transport, which is expected to contribute to ambitious plans to take thousands of cars off the roads and curb congestion.

It has been three years since the unveiling of the first prototype of the urban mobility system designed by Belarusian scientist Anatoli Unitsky, that costs a fraction of requirements to install a metro or tram system.

chief executive of uScovery and uSky Transport systems

Since then a working public service has become operational in Belarus, and a contract signed to deliver a 400-metre tourist track in Karnataka, India.

In Sharjah, developers said the flagship Karat complex shows designs are more than just a proof of concept, and hope the pods could soon be connecting key points in Dubai.

“Each new innovation takes time and what we are developing is not just a new railway, new port, or new machine,” said Oleg Zaretskiy, chief executive of uScovery and uSky Transport systems.

“This is the unique track structure that is developed for carrying both passenger, container pods and their load, without heavy concrete structures, and without spending money for building huge concrete bridges.

“This is our advantage, and why we are more affordable than other technologies.”

Several technologies are vying for the preferable choice for long-term sustainable, cost-effective transport.

Although the much-vaunted Hyperloop project has been recently resurrected with a potential passenger route between Venice and Padua, estimated costs of about $862 million are financially prohibitive.

Meanwhile, the China Aerospace Science and Industry Corporation (Casic) recently announced its new magnetically levitated (maglev) train had broken speed records in tests on a 2km track, reaching 623 kph.

String rail

While the string rail alternative offered by uSky Transport may not offer the same high speeds, it can be delivered at a fraction of the price.

A public tram system typically costs from $30 million to $40 million per kilometre of track, while the estimated costs to develop the planned 30km Blue Line metro in Dubai are about $4.9 billion.

A similar length of track using uSky string technology – where steel wheels run on steel rails – costs about $20m a km, the company said.

The uCar pod that began running in Sharjah along a 400m line in 2022 offered luxurious surroundings in a four-seater pod, but the latest uBus has a more functional, basic capacity to transport up to 25 passengers at a time.

The uFlash – a six seater long distance, aerodynamic pod with luggage space – also has luxurious leather seats and personal TV screens more akin to business air travel, as well as the capacity to travel at speeds approaching 500 kph.

The company is exploring where to construct a 20km aerial track to begin testing of high speed travel, using the same string technology, with costs estimated to top $230 million.

Under an agreement, uSky pays ground rent to the SRTIP to continue testing, with private financing backing the project towards the next development step – another 2.4km track alongside the existing Sharjah route.

By raising uSky networks off the ground, land is spared from the destructive development of a traditional transport system, such as road or rail.

Technology weathers the storm

Mr Zaretskiy said the fully operational Sharjah uSky transport system uses mechanical blowers to remove dust from the lines, and was tested in the recent storms of April 16 in the UAE, performing well in high-winds and heavy rain.

“Our system operating in Belarus has proved very successful, and comfortable for people,” he said.

“When somebody wants to make connection between two points, such as a bus stop and a hotel or a hospital - this is where we can come in.

“We have practical experience, and we have huge desire to be there.

“There are plenty of places in Dubai where it can be implemented connecting the shopping malls with hotels, for example.

“Our system gives an opportunity to move transport to the next level.”