A worldwide expansion of ground-breaking electronic technology by a British company has taken a major step forward after significant investment from Abu Dhabi.

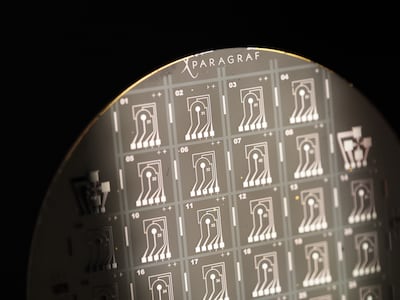

Paragraf, one of Britain’s most promising private technology businesses, which produces semiconductors made of graphene, has benefited from the Mubadala sovereign wealth fund contributing $35 million.

Graphene’s unique properties enable a host of devices to perform faster, more accurately and with lower energy consumption than silicon-based alternatives.

The input of $55 million in total funding, which includes a 12.8 per cent stake in the company acquired by Mubadala, will enable Paragraf to expand production of “faster, more energy-efficient technologies to the scale required by major commercial opportunities”, said Dr Simon Thomas, the company’s co-founder and chief executive.

“This investment is a strong signal of confidence in Paragraf. We’ve attracted strong interest and are pleased to have secured the backing of both new and existing partners who share our vision for transforming electronics with graphene.”

The Cambridgeshire company’s graphene molecular system can be used to produce liquid and gas sensors for the early detection of disease.

But they are especially useful in extreme environments, including cryogenic systems in quantum computing and in a range of high-temperature and high-radiation applications across industries.

Paragraf will now set up subsidiaries in the Middle East, China and the US. The company said it had a “vision to transform electronics” by being the first global company to use graphene for quantum computing, electric vehicles, energy storage and chemical testing, as well as helping to develop new cancer drugs.

The semiconductor company came within weeks of running out of money after the UK’s six-month national security checks delayed the foreign investment, Dr Thomas said. Paragraf was “pushed to the wire" in obtaining the funding.

Philip Harwood, Middle East regional director for the UK government’s office for investment, said Paragraf exemplified “the best of British innovation, research and technology”.

“This investment demonstrates the UK’s capacity to attract global capital for transformative industries,” he added.