In a display case in Iraq’s National Archives, a set of drawings on yellowish paper offers a window into the mind of the country’s last monarch, King Faisal II.

For decades the 143 pictures have been kept in the archives, with only a handful accessible to researchers and visitors curious about Iraq’s so-called boy-king, who ascended the throne at the age of three.

The National was given the chance to film the collection and the royal family archive for the first time.

The pictures shine a light on a tumultuous period in Iraq’s modern history, including the life – and gruesome death – of the king.

Born in 1935, Faisal II became the youngest reigning monarch in the world when he took the throne as an infant after the mysterious death of his father King Ghazi in a car accident in April 1939.

For nearly 20 years, the young king ruled Iraq through a period of extreme turmoil, including the Second World War.

But the king’s life was cut short when he was shot dead on July 14 1958 in a coup staged by a group of army officers to establish the first Iraqi Republic.

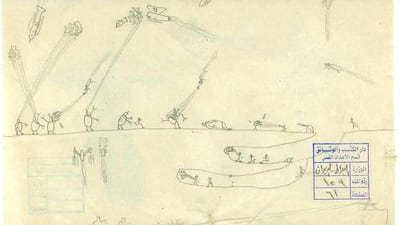

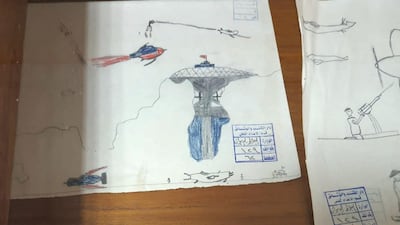

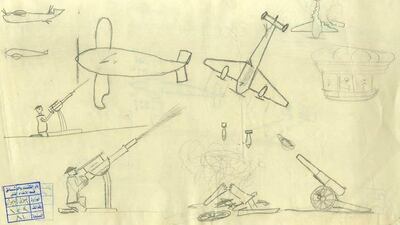

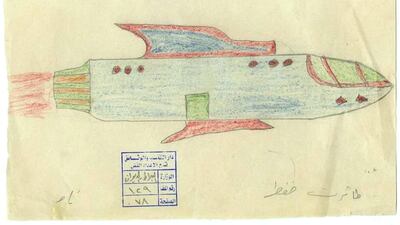

The drawings reveal that King Faisal’s early life was dominated by the backdrop of war during the 1940s.

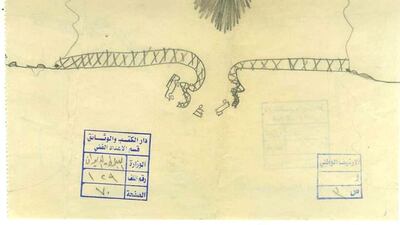

Most of the drawings, in pencil or crayon, depict fierce battles in open fields, at sea and in cities.

One shows an aircraft dropping bombs on a cannon, with two soldiers responding with anti-aircraft fire.

The fighting in Iraq seems to have captured the young king’s imagination.

The abandoned Surrey estate once home to an Iraqi king – in pictures

In 1941, British forces invaded Iraq to oust the pro-Axis government, which had toppled King Faisal II’s uncle, Regent Abd Al Ilah.

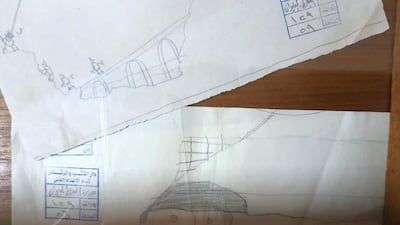

In one image drawn by the king as a child, fires blaze from the windows of a two-storey building as three tanks with British flags pass by.

The subject of the drawings was the result of the period the king lived through, Director of the Iraqi National Library and Archives Alaa Abu Al Hassan Al Alak told The National.

“There was the Second World War and the presence of the British troops at the country’s airports and bases,” Mr Al Alak said.

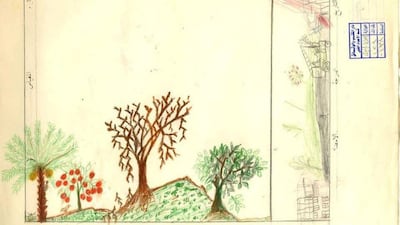

But some drawings depict more peaceful subjects, including landscapes, birds, buildings, as well as maps of Europe and North Africa.

During the war, the king went to Britain to live with his mother in Grove House, Berkshire, before returning to Baghdad to continue his education at the Royal Palace.

When he was a teenager, he studied at Harrow School in England with his second cousin and close friend, the future King Hussein of Jordan.

King Faisal II’s unusual upbringing in Iraq and Britain gave him a unique perspective on life, Mr Al Alak said.

“He lived his life as a king and a boy at the same time and that enabled him to think differently,” he said.

The royal family archive includes photographs, letters, films and maps for the Kingdom and the Rihab Palace that survived the 2003 US-led invasion that toppled Saddam Hussein. During the invasion and subsequent unrest, 40 per cent of the archives assets were destroyed or stolen, Mr Al Alak said.

As the world’s youngest royal ruler, Faisal II was famous in his lifetime.

Belgian cartoonist Herge based one of the characters in The Adventures of Tintin on Faisal II - the spoilt and mischievous Prince Abdullah of Khemed.

The fall of the pro-Axis government created a power vacuum, paving the way for the notorious Farhud, or pogrom, against the country’s Jewish community.

Hundreds of Jews were killed and their properties either looted or destroyed, marking the start of their emigration from the country.

By the time of King Faisal II’s 18th birthday in 1953, when the regency ended, the rise of Communism, popular unrest and pan-Arab nationalism had begun to threaten the region’s monarchies.

The overthrow of the pro-British Egyptian monarchy a year earlier had already undermined Faisal II’s claim to power.

The inexperienced king relied heavily on the advice of Crown Prince Abd Al Ilah and Prime Minister Al Said, both seen as closely allied with Britain.

Before dawn on July 14, 1958, army officers who opposed the monarchy, led by Brigadier Abdul-Karim Qassim and Colonel Abdul-Salam Arif, marched on Baghdad and attacked the Royal Palace.

"I heard an explosion at around 6-6.30 am and I jumped out of bed," King Faisal II's aunt, Princess Badiya bint Ali - the last surviving Iraqi princess - recalled in a 2012 interview with Al Sharqiya television. She died last year in London at the age of 100.

“I had a look at the Rihab Palace and saw smoke coming out of it,” she said.

King Faisal II, she said, offered to send guards to protect her but she refused.

Once inside the Palace, the officers ordered the king, his uncle and other family members into the garden, where they were all executed.

King Faisal II, then 23 years old, had planned to marry his fiancee Princess Fadila Ibrahim Sultan the next day.

She recalled how a member of the royal household rushed to her residence a few hours later, covered in blood and cried: “They killed them, they killed the king and his family.”

“I started crying and screaming,” she said. “When the kids’ English nanny asked me what was wrong, I said: They have killed my family.”