Rare jewellery placed in the mummified body of a teenage boy who died in Egypt about 2,300 years ago has been revealed using CT scanning.

Nicknamed "Golden Boy" by researchers, the teenager was discovered in a cemetery in 1916 but until recently had been stored in the basement of Cairo’s celebrated Egyptian Museum.

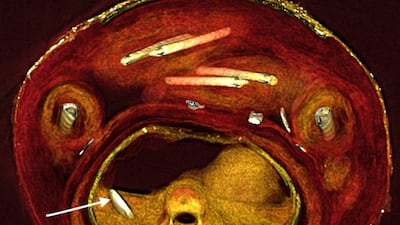

Without having to open up the mummy, researchers identified 49 amulets of 21 types, indicating that the boy enjoyed high socioeconomic status during his short life.

Many amulets were crafted from gold, while others were made from semi-precious stones, fired clay or faience, a type of glazed ceramic.

Cairo University

Their purpose, said Prof Sahar Saleem, of Cairo University, the first author of a study describing the mummy, was to protect the body and "give it vitality in the afterlife".

He said it was unusual for someone of the boy’s age — he was probably in his mid-teens — to be buried with so many amulets.

"The large number of amulets, with variety in shapes, many golden amulets, and the unique arrangement of the amulets in three columns are definitely extraordinary findings and may indicate the high class of the deceased," he told The National.

The mummy is now on display at the Egyptian Museum alongside computerised tomography images and a 3D-printed version of a heart scarab amulet.

New clues in 1916 mystery

The boy lived during the latter years of the Ptolemaic Kingdom, an Ancient Greek civilisation in Egypt, and was found in 1916 at a cemetery in Edfu, a city near the west bank of the Nile between Aswan and Esna. The cemetery was in use from 332 to 30 BCE, the year the Ptolemaic Kingdom ended with the death of Cleopatra VII.

Prof Saleem and two researchers from the museum used CT scanning, which is widely used in medicine to look inside the body, to reveal the mummy’s extraordinary secrets.

"I use CT to do non-invasive examination of fully wrapped mummies or sealed artefacts that had been kept in the basement of the museum without being studied or examined before," said Prof Saleem, a professor of radiology in Cairo University’s Faculty of Medicine.

"The objectives of the work were to study the object to register information in the museum’s registration book, to find objects that needed repair or preservation, and to promote some objects to be displayed in the museum."

The mummy, described in a new paper in the journal Frontiers in Medicine, was laid inside an outer coffin with a Greek inscription and an inner wooden sarcophagus.

In Ancient Egypt, the dead were buried with possessions that it was thought could be useful or provide sustenance in the afterlife.

Egyptians believed that a person’s spirit had to navigate an underworld filled with unusual creatures, gods and gatekeepers before reaching the Hall of Final Judgement, where the dead would plead their case with divine judges for entry into the afterlife.

Book of the Dead

The amulets were arranged in three columns between the folds of the wrapping and inside the mummy’s body cavity.

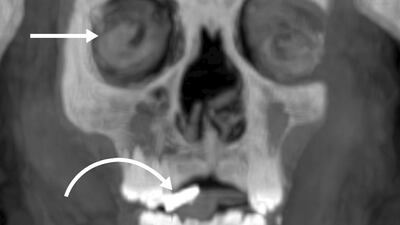

A gilded head mask had been placed on the boy’s head, while he wore a pectoral cartonnage, a covering for the chest, and a pair of sandals.

"The sandals were probably meant to enable the boy to walk out of the coffin. According to the ancient Egyptians' ritual Book of The Dead, the deceased had to wear white sandals to be pious and clean before reciting its verses," Prof Saleem said, referring to the civilisation's funerary text.

The teenager was garlanded with ferns around his body, tying in with the ancient Egyptian practice of placing bouquets of plants and flowers beside the dead.

“Ancient Egyptians were fascinated by plants and flowers and believed they possessed sacred and symbolic effects," Prof Saleem said.

A golden tongue amulet had been placed in the teenager’s mouth so that he could speak in the afterlife, while "balance and levelling" were provided by a right-angled amulet.

The heart had been removed, as had many of the other organs in the "high-quality mummification process", while the brain was taken out through the nose and replaced with resin.

In place of his heart, a golden scarab beetle amulet had been put inside the chest. This amulet is said to have silenced the heart on Judgement Day so that it could not bear witness against the dead person.

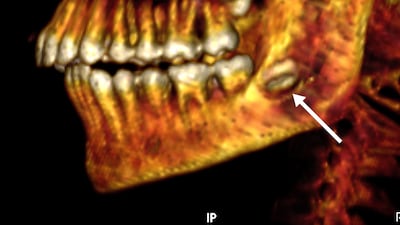

Based on the extent of bone fusion and the development of the wisdom teeth, the researchers estimate that the boy was between 14 and 15 years old when he died.

There was nothing obvious to indicate how he died so despite his young age, suggesting that he may have succumbed to natural causes. His teeth were in good condition, with no sign of cavities or gum disease.

He had not been circumcised, and Prof Saleem said it was likely that circumcision was not carried out before adulthood.

Prof Saleem has carried out CT and X-rays of hundreds of mummies, including scans of more than 40 royal mummies, including Tutankhamun, from the New Kingdom (which lasted from the 16th century BC to the 11th century BC) as part of a major government initiative, the Egyptian Mummy Project.

"I have also done facial reconstruction on royal mummies based on their CT scans (Tutankhamun and Ramesses II). I hope to continue reconstructing the face of other royal mummies as part of the Egyptian Mummy Project," he said.