If 2020 has taught us one lesson, it’s that anything can happen — even the entire world grinding to a halt.

This is why some experts believe that people around the world need to be prepared for something much worse than a pandemic, such as a zombie apocalypse.

The Centres for Disease Control and Prevention in the US has updated its guide to surviving a zombie invasion. It might be a tongue-in-cheek campaign, but it's full of practical tips on how to survive a real emergency.

“The rise of zombies in pop culture has given credence to the idea that a zombie apocalypse could happen. In such a scenario, zombies would take over entire countries, roaming city streets, eating anything living that got in their way,” the health authority writes in a blog post.

“You may laugh now, but when it happens, you’ll be happy you read this, and hey, maybe you’ll even learn a thing or two about how to prepare for a real emergency.”

First things first

The first thing you need to do to prepare for a zombie invasion is to have an emergency kit to hand, according to the CDC.

“This includes things like water, food and other supplies to get you through the first couple of days before you can locate a zombie-free refugee camp (or in the event of a natural disaster, it will buy you some time until you are able to make your way to an evacuation shelter or utility lines are restored),” it writes.

The must-have items in your kit are:

- Water (about four litres per person per day)

- Food (non-perishable items that you eat regularly)

- Medications (prescription and non-prescription)

- Tools and supplies (utility knife, duct tape, battery powered radio, etc)

- Sanitation and hygiene (household bleach, soap, towels, etc)

- Clothing and bedding (a change of clothes for each family member and blankets)

- Important documents (copies of your driver's licence, passport and birth certificate etc)

- First aid supplies

"Although you're a goner if a zombie bites you, you can use first aid supplies to treat basic cuts and lacerations that you might get during a tornado or hurricane," the CDC clarifies.

Plan your escape

Once you’ve made your emergency kit, you should sit down with your family and come up with an emergency plan, the CDC writes. “This includes where you would go and who you would call if zombies started appearing outside your doorstep. You can also implement this plan if there is a flood, earthquake or other emergency.”

The step-by-step guide on how to execute an emergency plan includes firstly identifying the types of emergencies that are possible in your area. “Besides a zombie apocalypse, this may include floods, tornadoes or earthquakes," it advises.

Next, pick a meeting place for your family to regroup. "Pick one place right outside your home for sudden emergencies and one place outside your neighbourhood in case you are unable to return home right away."

Also, identify emergency contacts.

“Make a list of local contacts like the police, fire department and your local zombie response team. Also identify an out-of-state contact that you can call during an emergency to let the rest of your family know you are OK,” says the CDC.

Finally, plan an evacuation route.

“When zombies are hungry they won’t stop until they get food, which means you need to get out of town fast,” the CDC points out.

“Plan where you would go and multiple routes you would take ahead of time so that the flesh eaters don’t have a chance. This is also helpful when natural disasters strike and you have to take shelter fast.”

The health authority is also urging educators to teach schoolchildren the basics of emergency preparedness and response. Its online resource features a list of activities, simulations and lessons on how to teach students to make decisions when facing unexpected events.

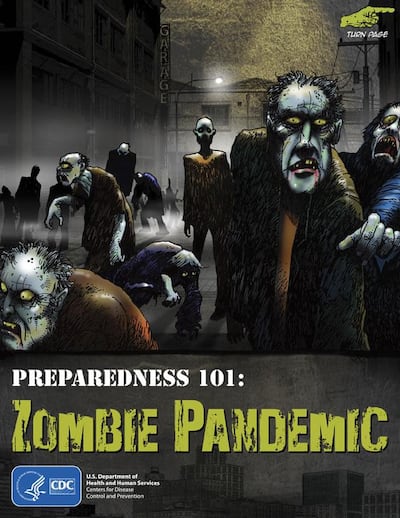

It's even published a graphic novel, Preparedness 101: Zombie Pandemic, which it says "demonstrates the importance of being prepared in an entertaining way that people of all ages will enjoy".

Included in the novel is a preparedness checklist so that readers can get their family, workplace or school ready before disaster strikes.