For Ashok Batra, an insurance executive who lives in the Defence Colony district in New Delhi, evening television--viewing used to be a chore performed with clenched teeth. His mother and sister are addicted to Hindi--language soap operas featuring gaudily made-up, Machiavellian women stirring up trouble in the extended families they live in.

When Batra’s father got home from work, the channel was quickly switched to prime-time news. With only one television in the house, Batra, 25, had no choice but to put up with it.

Then in February, the Batras brought home a second television set. And in the middle of March, to Batra’s delight, a new men’s entertainment channel called Big RTL Thrill was launched, giving him exactly the programmes he wanted to watch.

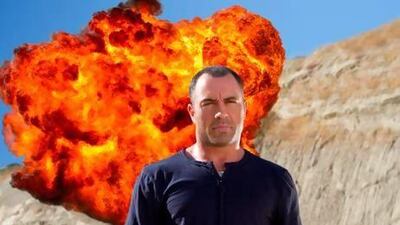

With the tagline “Action ka Baap” (the father of action), India’s first dedicated men’s channel offers international reality shows, wrestling, extreme sports, games, stunt and magic shows, as well as movies and series – all dubbed in Hindi. Its target audience is Indian males between the ages of 14 and 44.

“I like Cobra 11 [an American adventure series about an ex-Navy Seal] and Criss Angel [also American, about a magician and illusionist]. It’s gripping stuff from all over the world. And the standards are high, unlike the amateurish stuff on the other channels,” says Batra.

The channel is owned by the Reliance Broadcast Network, which has teamed up with the European entertainment group RTL to fill what it claims is a void in Indian television. For example, the action and entertainment channel AXN is available in India but in English.

“We realised that there was a need for a one-stop destination for male entertainment that offered the whole package. As more and more consumers choose to have two televisions in their homes, male viewers are beginning to ask for better options,” explains Sunil Kumaran, the business head of regional TV, Reliance Broadcast -Network.

The channel, first launched in the northern state of Uttar Pradesh in November and recently in Mumbai and New Delhi, aims to reach at least 6.5 million households across both cities.

“Within four weeks of our launch in Uttar Pradesh, we were the leading entertainment channel. The response has been great. Because our programming is broad-based, there is something for every male,” says Kumaran.

The unusual advertisement campaign for the channel has also attracted attention. To promote the show Fear Factor: Darr se Takkar, bus shelters in New Delhi and Mumbai have been given the feel of a snake pit, with battery-operated serpents slithering inside a glass box built on top of the shelter. People waiting around for a bus are intrigued – as they are meant to be.

But a few blogs have questioned the need for a men’s action TV channel, following nationwide outrage at the way women are treated in India, a topic sparked by the fatal gang-rape case in New Delhi last year.

One blogger wrote: “In the current environment, where the threat of violence against women is palpable, there is an obvious concern about the success of a television channel offering ‘action’ content to a young male audience.”

But Kumaran is amused at the charge that Big RTL Thrill will cause testosterone and adrenalin levels to soar and men to seek illicit thrills.

“Look at our programming. We offer entertainment, not violence. What do Fear Factor, Baywatch, Shock TV, Wipeout and dirt biking have to do with violence against women? We’re offering fun, not peddling dangerous ideas,” he says.

Kumaran adds that the fear that men might “get all charged up” after tuning in to the channel seems particularly misplaced, especially as there are more important issues to focus on, such as the decades-long portrayal of women in family soaps as hissing vipers.

“That’s the kind of stuff we really need to worry about. These negative stereotypes of women are so insidious,” Batra says. “In contrast, I think sports and action programmes are harmless – they are good for the whole family.”

Interestingly, Kumaran says, Big RTL Thrill has many female viewers, such as Anita Duggal, who owns a beauty salon in New Delhi. “Sometimes I just want to relax by watching amazing stunts,” she says. “I don’t watch the news because it’s depressing and I hate family dramas, so I’m enjoying this new channel.”

artslife@thenational.ae

Follow us

Follow us on Facebook for discussions, entertainment, reviews, wellness and news.