For parents who enjoy reading — or even those who want to introduce the hobby to their children — motivating a reluctant young reader can be tricky. However, it is not impossible, say experts, so long as parents keep the following methods in mind.

Identify reasons for reluctance

The first step, says children’s book author Lesley D Biswas, is to explore why your child may be reluctant to pick up a book. Perceiving reading as a boring activity, not discovering the right book to pique curiosity or suit reading levels, as well as pressuring children to read in order to improve academic performance rather than for pleasure could be some reasons, she explains.

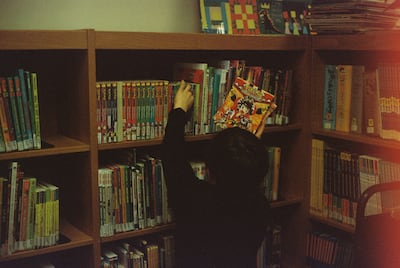

“Allow your child to choose their own books and read for fun,” adds Biswas. "Introduce a variety of titles by different authors, across genres and interests. Visiting bookstores, book fairs, book events or gifting a library membership can be some options."

It is also important to differentiate between a reluctant reader and a struggling reader. A child who seems to be unwilling could be facing reading difficulties or vision issues, in which case seek expert guidance.

When and how to start

Starting early is important. Writer and children’s book author Anita Satyajit says: “Ideally, we should give children a book in the hand the moment they can hold one.”

For young children, choose illustrated books with bright imagery and read aloud to them by pointing to pictures.

author

“If you aren’t one already, become a reader yourself and let your child see the grown-ups around them reading for pleasure,” says Shruthi Rao, who writes books of fiction and non-fiction for children.

Seek recommendations from other parents, neighbourhood bookstores or a library, Rao adds. “Once the child is old enough, let them take the initiative and choose the books they want to read," she says.

Variety is the spice of life

Ekta Bhandari is the co-founder of Read A Kitaab, a community of readers worldwide. Illustrated pages aside, she suggests introducing activity books and those with a child’s favourite cartoon characters to capture interest.

children’s book author

“Not everyone likes the same flavour of chocolate. Similarly, not everyone likes the same kind of books,” says Satyajit, who believes in offering children any and all age-appropriate reading material, from magazines, comics and graphic novels, to recipe books, manuals and maps to encourage exploration. The key is to build the foundation with patience and experimentation.

Ignite curiosity

Forcing the issue is not an effective tactic when it comes to inculcating a lifelong love of reading, so try to captivate instead of coerce.

One tactic is to bring up a character or plot line hours or even days after the book has been read, another is to draw parallels between the book and the child’s own interests. “Try linking a book, character or plot line to their life," suggests Satyajit. "So ask something like: ‘The child in this book made this choice, but what would you do?’

“Focus on topics of interest. For example, if a child likes cricket, then a book where the main character plays cricket could help.”

Biswas adds: “If they get invested in the first book of a series, they’re likely to complete the series.”

Another solution for children who enjoy watching movies is to proffer books that have been adapted into films.

Time and place

Creating a cosy reading corner helped capture the attention of Vanita Mishra's daughter Siya. The family built a little nook with cushions and a low table. “We transformed a wooden crate into a bookcase and Siya happily placed her books with ours and started sitting with us,” says Mishra. Initially, Siya, five, would flip through pages for a few minutes and leave, but soon the time she was spending in the nook increased.

“For bookworms, everywhere is a reading place and every time is a reading time,” notes Rao, but says some children may work better within a structure. In such cases, having family time to read books can work wonders even if they read only for a few minutes or a few times a week to start with.

Reading at bedtime is another option. Have a cut-off time for screens and devices gadgets to help children turn to a book rather than other distractions. Satyajit says: “There is nothing as comforting as snuggling into bed with a book. Get into bed and read with them; it does not matter if they are three or 13.”

Birds of a feather

Biswas suggests making reading a social activity among older children, who can discuss themes, favourite characters, how they do or do not relate to them and even what they would change if they were the author.

Read A Kitaab chooses a book of the month for children to read and discuss online. “We offer a calm and safe space to interact and exchange ideas, provide an online library and schedule book discussions, nuanced talks and author conversations,” says Bhandari.

Following a session that required children to prepare a brief monologue on the books they had read, she says: “We received feedback from so many parents that their children can now speak more confidently on subjects and are reading more regularly.”

Younger children may benefit from storytelling sessions, says Satyajit, especially those who enjoy group rather than solo activities.

However, Rao cautions group sessions will only help if the child is open and willing to communicate. If not, she says: “Forced book discussions could backfire”.

Digital props and pitfalls

Often reluctant readers prefer screens to books and many children are more attracted by live movement than stationary pages. Satyajit says reducing screentime is an effective strategy to push books to the forefront, while Bhandari notes: “Books provide an opportunity for parents to interact and talk with kids, and might, in turn, help them cut down on digital media usage.”

However, forcing children to read books by cutting into screen time can be detrimental, leading them to "resent" reading, Rao says. The ideal approach, she adds, is to introduce them to books slowly, which will naturally reduce screen time.

While reading paper books can decrease the use of digital media, Kindle and audiobooks can encourage reading, especially for children who are keen listeners as well as those with ADHD or learning disabilities.

“For children who love listening to stories, audiobooks can be a fantastic catalyst as well as help a child rest their eyes,” says Biswas.

One disadvantage is that audiobooks are passive and not much help when it comes to identifying words, thus affecting a child’s reading ability, cautions Bhandari.

Pick your battles

In a family of enthusiastic readers, there may be one child who prefers to dance, sketch, paint or play instead of reading. Therefore, while parents can patiently explore creative options to encourage engagement, some may also need to accept reluctant children will never become voracious readers, adds Rao.

“Some kids will never love reading, so don’t force them,” says Rao. “There are so many more things to do. They might gravitate to books later in life or they may never warm to books, and that’s OK, too.” Accepting your child's preferences and understanding that not liking books doesn’t make them lesser than their peers who love reading, is essential, she adds.