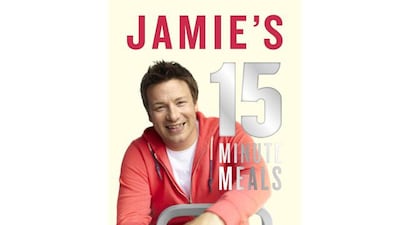

Jamie Oliver's latest book, Jamie's 15-Minute Meals, launched earlier this week, with Oliver promising recipes for "delicious, nutritious, super-fast food that's a total joy to eat and perfect for busy people like you and me".

This is the follow up to 2010's Jamie's 30 Minute Meals, which was rather successful – it became the fastest and best-selling non-fiction book of all time in the UK. 30 Minute Meals wasn't without its critics, though, with many complaining that the meal plans took far longer than half an hour to prepare and were really quite costly.

I own a copy of the book and would have to agree. While it offers a brilliant, bright selection of recipes – the chicken pie, prawn curry and dan dan noodles are particularly good – I’ve long since given up trying to finish them in 30 minutes and my kitchen is a neater, less chaotic place as a result.

With 15-Minute Meals, Jamie and his team seem to have paid heed to criticism and focused on more simple, accessible recipes. In the words of the man himself, he's providing ideas for "tasty, quick, affordable food".

Why not put him to the test? If you visit Jamie Oliver's Facebook page you can download two of the recipes for free. I plan to try the seared Asian beef with noodle salad and ginger dressing this weekend.