On what was described as Enron's first earnings call in 25 years, the infamous energy company's chief executive acknowledged the accounting scandal that collapsed the company in 2001.

Connor Gaydos, the new leader of Enron – the American company that was rocked by the discovery of widespread fraud, leading it to file for bankruptcy – was flanked by the company's famed tilted E logo as he reflected stoically on the past.

"This company has a legendary history and some of it is good and some of it is bad," he said in a Zoom call attended by hundreds.

"That's fine, Enron's name has always carried weight, and we don't run from that – we embrace it."

Some view it as parody, others as performance art. Whatever it is, Mr Gaydos now owns the Texas-based company that had about 20,000 employees and more than $47 billion in assets before it collapsed.

The company primarily focused on electricity and natural gas, as well as trading in energy and physical commodities. It also offered financial and risk management services to other businesses.

An archived version of Enron's website claimed more than $100 billion in revenue as of 2000.

But whistle-blowers revealed rampant fraud, much of it in the form of egregious accounting methods, which destroyed the company and brought an end to a boom rooted in economic and energy deregulation starting in the mid 1990s.

As a result of the crisis, Enron's former chief executive, Jeffrey Skilling, served more than a decade in prison. The company's founder and former chairman, Kenneth Lay, probably would have been jailed had he not died before his sentencing. The company's former chief financial officer, Andrew Fastow, also served a prison sentence.

Enron was at the heart of one of the biggest US corporate scandals of all time. It now serves as a cautionary tale for companies, investors and consumers.

"Enron was always something that I had thought about since I was a child," Mr Gaydos told The National, days after Enron's earnings call.

The 29-year-old, originally from Arkansas, reflected on the tainted company's happier and more prosperous days, describing it as the "OpenAI or Nvidia of the mid 1990s".

He explained that his decision to restart the notorious company stemmed from viewing a documentary about its fall from grace. He looked up the Enron logo in the US trademark database and noticed that ownership of the symbol – by graphic designer Paul Rand, who also created the logos for IBM, Westinghouse, UPS and ABC – had expired.

Mr Gaydos hired a lawyer who helped with the trademark acquisition paperwork. For a few hundred dollars, including legal fees, he became the owner of the Enron brand. "It cost me what I think the price of cup of coffee will cost in a few years," he joked, referring to inflation.

In late 2024, Enron announced its comeback through accounts on Instagram, X and TikTok – which did not exist when the company went under in 2001. Now, Enron has about 500,000 followers on those social platforms.

"We're here to lead by example...we are Enron," a promotional video for the company said.

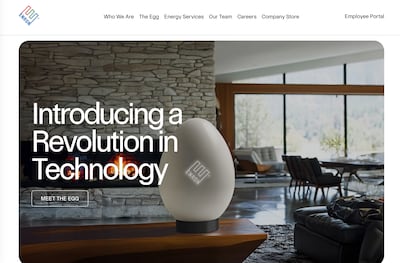

Since that video came out, Mr Gaydos has done several interviews and the company has heavily promoted a fanciful product it calls the Enron Egg, which it describes as a personal nuclear reactor "made to power your home for up to 10 years".

Several people purporting to be board members and high-level staff members took part in the recent earnings call. "I've got 60 people on the payroll right now," Mr Gaydos said.

The company also recently promoted a 2025 summer internship programme and a commitment to corporate diversity.

Although it is his first time leading a prominent brand, it is not the first time Mr Gaydos has been in the spotlight. He is one of the creators of Birds Aren't Real, the viral, performance art conspiracy theory designed as a critique of the abundance of misinformation pumped out on social media.

Mr Gaydos said the main thrust of the project was to show how the internet had been used as a tool to divide people. With the Enron endeavour, however, he wants to do something different.

“I want to unite people using the toolbox that we used with Birds Aren’t Real, but do it in a way that can hopefully shine a light on some of the areas that deserve to be exposed with the energy business,” he explained.

Mr Gaydos said in the two decades since Enron’s financial implosion, energy business consolidation, government subsidies and policies that lack environmental awareness have run amok. Consumers have suffered while energy profits have soared, he added.

He said his version of Enron was in the process seeking approval to become a retail energy provider. The Enron brand owner said that, in Texas, 10 “legacy monopoly companies” supply energy to about 60 per cent of the population.

Mr Gaydos accused those companies of vague pricing and outsourcing customer service to artificial intelligence. Without going into specifics, Mr Gaydos said Enron wanted to present Texas residents with a straightforward and economical path to provide energy to their homes or businesses.

“The energy monopoly in this country has got so out of hand,” he said, before changing to a more optimistic tone, adding that his goal is to bring back Enron and create a new company that will revolutionise energy. “If there's a few jokes along the way, and if some people laugh along the way, so be it."

Speaking with Mr Gaydos, it is sometimes difficult to tell what is real and what is parody.

One of the project's staff members who co-ordinated the interview insisted the push to become a retail energy provider was real. "Stay tuned," they said. "Enron has a lot of interesting stuff coming down the pike."