A perfect mix of technology turbulence and geopolitical developments caused Nvidia stock to dive on Wednesday, with shares down by more than 6.8 per cent.

Investors digested a filing Nvidia made with Securities and Exchange Commission (SEC) warning that US government export rules related to its H20 AI chip would cause it to be hit with $5.5 billion in charges.

Nvidia shares fell to $104.49 per share.

Its dip accompanied a broader selloff in US markets with the Dow Jones Industrial Average shedding 699 points, or 1.7 per cent. The S&P 500 fell 2.2 per cent.

The export regulation causing so much consternation, and similar rules on the horizon, are largely designed to keep US AI technology from being used in increasingly adversarial countries like China.

Nvidia, Microsoft, and other technology companies have not been shy about expressing displeasure over the export policies.

Many have issued statements opposing policies largely crafted by the Biden administration, known as “AI diffusion rules”. Proponents say these policies seek to protect the US lead in AI, but critics say they will harm US technology companies and ultimately backfire.

Besides US President Donald Trump, the decision about chip exports will ultimately fall to US Commerce Secretary Howard Lutnick, who has also been at the receiving end of criticism about the forthcoming rules. The AI diffusion policy is slated to take effect on May 15.

On Monday, Republican senators Pete Ricketts, Thom Tillis, Ted Budd, Eric Schmitt, Markwayne Mullin, Roger Wicker and Tommy Tuberville sent a letter for Mr Lutnick, urging him to withdraw the policy.

“Immediate action is necessary to prevent irreversible damage to American innovation and competitiveness,” they wrote. “Every day this rule remains in place, American companies face mounting uncertainty, stalled investments and the risk of losing critical global partnerships that cannot be easily regained.”

The letter also points out that the diffusion policy penalises US allies. Under the proposed rules, countries such as the UAE, India, Saudi Arabia, Singapore and Israel will find it more difficult to bolster AI development with US technology.

Last week, Ben Buchanan, a former Biden administration AI policy official, defended the AI diffusion rule and addressed criticism from Nvidia.

“The argument was that we were limiting who these US companies can sell these chips to and therefore limiting the revenue of these companies,” Mr Buchanan said. “Nvidia's stock, prior to the tariffs at least, did very well and they've done just fine, because there's extraordinary demand for AI chips.”

Also affecting the California tech company are various reports that China's Huawei Technologies is ready to launch AI infrastructure products that could rival Nvidia offerings.

The South China Morning Post, sourcing a publication called STAR Market Daily, describes Huawei's CloudMatrix 384 Supernode that allegedly goes toe-to-toe with Nvidia's AI infrastructure products.

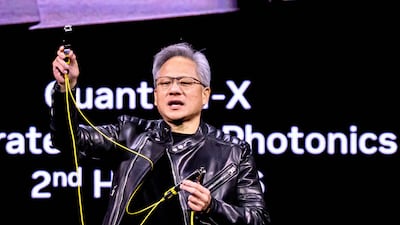

Although Nvidia chief executive Jensen Huang has not commented on the CloudMatrix, in recent months he has made no secret that he considers Huawei to be a significant player and potential competitor in the AI sector.

“They have conquered every market they've engaged,” he told The Financial Times, adding that Huawei's “presence in AI is growing every single year.”

Huawei has yet to confirm the existence of CloudMatrix 384.

Speaking more broadly about the industry landscape to CNBC in March, Mr Huang reflected on regulatory efforts linked to AI.

“It’s safe to say that we can’t hold any country back or anyone back in advancing or developing intelligence, and surely AI is just digital intelligence,” he said. “If everyone is going to be developing it, let’s make sure they develop it on American technology, American architecture and American standards.”

Yet even amid regulatory efforts such as export controls and potentially tariffs, implementing that American technology all over the world is proving more difficult than anticipated.

Nvidia has announced it would be working with partners to build factories to produce AI supercomputers entirely in the US.

The US Department of Commerce did not respond to the The National's requests for comment on the AI diffusion policy.