The UAE has announced its precautionary Covid-19 measures for the coming Commemoration Day and 50th National Day events.

Negative PCR test results will be required to attend events and gatherings. Masks will need to be worn when in proximity to other people.

Attendees will not need to maintain social distancing from members of their own family, however.

The National Emergency, Crisis and Disaster Management Authority set out the regulations on Tuesday during its weekly Covid-19 briefing.

"Let us celebrate safely, and preserve the gains and efforts made for the state for the sake of our health and safety," an Ncema representative said.

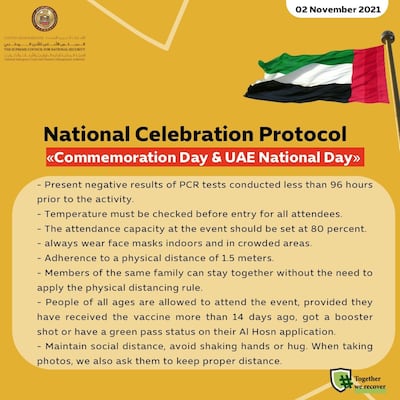

The rules announced are as follows.

- to attend a celebration, attendees must be able to present a negative PCR test taken within 96 hours of the event

- event capacity is 80 per cent, and temperatures should be taken before entry

- masks must be worn at all times while indoors or when the event is crowded

- a physical distance of 1.5 metres must be respected – however, one family is allowed to sit or stand together without the need to apply physical distance

- people of all ages are allowed to attend the event, provided they have received a vaccine more than 14 days ago, received a booster shot, or have a green-pass status on their Al Hosn application

- greetings should be given from a distance, without handshakes or hugs

- social distancing should also be respected during photographs

Ncema rules now primarily cover Abu Dhabi, although most of the other emirates base their Covid-19 rules on these guidelines.

According to Bloomberg Covid Resilience Ranking for October, the UAE is third in the world and first regionally when it comes to dealing with Covid-19.

"This reflects the efficiency of its leading model in managing the crisis," the Ncema representative said.

Rules for celebrations

Event organisers will be required to form teams to ensure that the safety requirements are carried out and respected. They will also ensure that entry and exit is carefully organised to prevent crowding.

Continuous and periodic disinfection is also required. Hand sanitiser should be placed at the entrances and exits of public toilets.