The planned expansion of the Brics bloc, through the addition of six members, will transform the group into a global leader in renewable energy in the coming decades, a report has said.

The UAE, Saudi Arabia, Iran, Egypt, Ethiopia and Argentina are expected to join the Brics group – which comprises Brazil, Russia, India, China and South Africa – in January 2024.

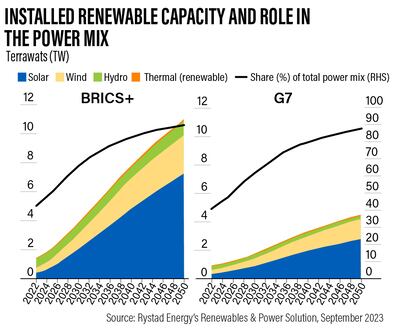

The bloc is expected to derive more than 80 per cent of its power from renewable sources by 2050, with total capacity reaching 11 terawatts, more than double the combined 4.5 terawatts expected in the Group of Seven nations, Rystad Energy said.

“Renewable energy is rapidly gaining prominence as costs decline, making it an increasingly attractive prospect for investors in the Brics+ nations,” the Oslo-based consultancy said.

The abundant natural resources and affordable labour in most member countries “creates an opportunity for significant growth in gross domestic product per capita, while population growth remains relatively conservative by comparison, underscoring the economic strength of some of the incoming members”.

Current Brics members such as China and new members, including the UAE, are playing a critical role in the energy transition, with new projects and supply of critical components required to build renewable projects including batteries and solar panels.

The Emirates aims to become net zero by 2050 and is investing heavily in building new projects, including a two-gigawatt solar plant in Abu Dhabi's Al Dhafra region, as well as the Mohammed bin Rashid Solar Park in Dubai with a five-gigawatt capacity.

Under the updated version of the UAE Energy Strategy 2050 and the development of the National Hydrogen Strategy, the Arab world’s second-largest economy aims to invest between Dh150 billion ($40.8 billion) and Dh200 billion ($54 billion) by 2030 to ensure energy demand is met, while sustaining economic growth in the country.

Abu Dhabi’s clean energy company Masdar continues to expand its operations globally. It is currently active in more than 40 countries and has invested in or committed investments to projects worth more than $30 billion.

The company aims to grow its capacity to at least 100 gigawatts of renewable energy by 2030.

Saudi Arabia also announced a number of new renewable projects as part of its 2060 net-zero strategy including a 2.1 gigawatts capacity solar plant in Makkah that will be developed by Acwa Power and Badeel, a unit of Public Investment Fund.

“The Brics+ alliance is fundamentally reshaping the global energy landscape, challenging established paradigms and committing to ambitious sustainability targets,” said Lars Havro, senior analyst of Rystad Energy.

“As this emerging superpower’s economies expand and energy demands continue to evolve, ensuring a stable and secure energy supply will become paramount.

“This provides an opportunity to directly shift towards advanced sustainable energy infrastructure rather than relying on outdated frameworks.”

Adoption of electric vehicles is also on the rise across the Brics bloc, with China leading the world in pure battery EV (BEV) sales, outpacing G7 countries.

EVs are expected to account for more than 60 per cent of all new car sales in the expanded bloc by 2035, according to Rystad.

“Furthermore, as the bloc continues to invest in EV charging infrastructure and maintain its lead in battery technologies and raw materials processing, the share of EVs in total vehicle sales across the Brics+ nations is projected to reach 86 per cent by 2040 under a 1.6ºC global warming scenario,” it said.

The Brics+ bloc is also poised to play a pivotal role in global oil production, with members set to collectively meet two thirds of the world's crude oil demand.

Saudi Arabia, UAE and Russia have some of the world’s largest proven oil reserves.

“Within an evolving landscape, Brics members such as Russia and newcomer Saudi Arabia are primed to play vital roles,” Rystad said.

India has significantly increased oil imports from Russia after the Ukraine conflict and subsequent western sanctions on Moscow.

India’s oil imports from Russia have surged from 1 per cent before the conflict to 34 per cent, totalling 1.64 million barrels per day as of March this year.

In terms of natural gas production, the expanded Brics bloc will account for 37 per cent of liquids and 33 per cent of gas production globally, underscoring the importance of the group.

Energy exports are going to become the main focus as the bloc expands, with new members joining next year.

“While traditionally recognised as a major energy consumer, this transformation positions Brics+ as a net exporter of primary energy,” Rystad said.

The bloc is expected to produce an energy surplus, surpassing the consumption levels of its largest members, “thanks to the energy exporter status of several newly added members, most notably Saudi Arabia”, it added.

In stark contrast, the energy dynamics of the G7 nations present a different narrative, according to the report.

Despite commendable strides in energy efficiency and production, the G7 remains a net importer of primary energy.

“The G7 faces multifaceted challenges regarding energy sovereignty, including control over clean tech supply chains, technological leadership, job creation, reducing reliance on volatile regions and maintaining economic competitiveness,” it said.