The nuclear power sector will use Cop28 in Dubai to position itself as “part of the solution” in tackling climate change, the head of the UN’s atomic watchdog told The National on Monday.

Rafael Grossi, the director general of the International Atomic Energy Agency, expressed his hope that nuclear fusion could be up and running in time for 2050 climate deadlines.

Mr Grossi hailed “momentous achievements” in fusion as he unveiled an IAEA report in London on what one UK minister called the “holy grail” of clean energy.

Britain will put new funding into training and research on fusion as the world “reawakens to the potential” of nuclear technology, said Andrew Bowie, under-secretary of state for nuclear and networks.

Existing nuclear fission plants are hailed by the industry as stable, low-carbon sources of electricity, while opponents raise concerns over safety and radioactive waste.

With debate raging over whether nuclear plants should be put in the same “green” bucket as renewables such as wind and solar, Mr Grossi told reporters that climate discussions were no longer a “nuclear-free” zone.

Asked by The National about expectations for Cop28, he said the annual UN climate summits were “a very important place where the IAEA has been trying to be more present and more visible”.

In Dubai “we are going to be affirming very clearly that nuclear is part of the solution”, Mr Grossi said.

“We do not have a beauty contest approach in these things. We are not peddling nuclear just for nuclear. We believe that nuclear is playing an excellent role in providing clean energy.”

The UAE’s presidency of Cop28 has made “fast-tracking the energy transition” one of four key themes of the summit, along with finance, inclusivity and livelihoods.

Dr Sultan Al Jaber, Cop28’s President-designate and UAE Minister of Industry and Advanced Technology, told a Brussels meeting in July that the world “needs to use every emission-busting tool available, including nuclear”.

Fusion prospects

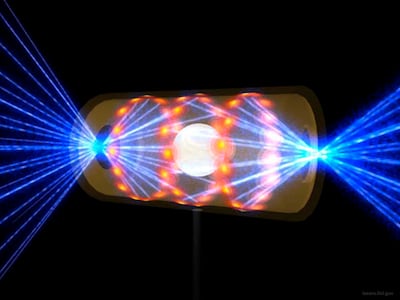

The longer-term hope is that nuclear fusion – a similar process to the one that powers our Sun – can be harnessed to produce colossal amounts of energy, ideally with less of a radioactive waste problem.

Technology has been in development for decades and the London conference heard “significant technological challenges remain ahead”. Fusion needs temperatures above 100 million °C, using vast amounts of energy.

Until recently, fusion had always cost more energy than it produced, but the first ever net “energy gain” was made in 2022 and repeated on a larger scale in July this year.

The UK hopes to get a prototype fusion plant up and running by 2040, with views differing on whether the technology will arrive in time for 2050 net zero goals.

“Of course we want to see it before that and I think there is a very good chance … there is a solid basis to think that if we get it right, then fusion could also be part of the combo,” Mr Grossi said.

But either way “it would be counter-intuitive if not outright silly to say we’ve reached the deadline in 2050 so now we don’t need it any more,” he said.

“The world will continue after 2050, and it will need clean energy on a massive scale beyond that date.”

Referring to the “old quip” that fusion will always be the energy of the future, Mr Grossi said this was “not any more” the case, as he welcomed the recent breakthroughs.

“The ambition is to bring fusion energy to the economy, to make it part of the energy mix of the not too distant future,” he said.

The UK is home to one of the world’s leading fusion experiments, a pan-European initiative known as the Joint European Torus. but Jet is set to be decommissioned after 40 years, as Britain pursues its own post-Brexit projects.

A £650 million ($792 million) fusion package announced on Monday will put some money into a prototype UK plant known as Step, as well as offering hundreds of training places in the fusion industry.

Mr Bowie said the UK government “is serious about the future of fusion”, which he described as the “holy grail of energy production”.

He said the goal of “unlimited, clean, safe energy” was “no longer a theoretical dream but a very real prospect”.