Global smartphone sales plunged 20 per cent year-on-year in the first quarter of 2020 due to the coronavirus pandemic, according to the Gartner consultancy.

Overall, 299.1 million smartphones were sold in the first three months, almost 75.8 million less than the same period last year, as Covid-19 disrupted supply chains and prevented consumers from spending on non-essential products, according to the latest data from Gartner.

Most of the leading Chinese manufacturers and California-based Apple were “severely impacted by the temporary closures of factories in China and reduced consumer spending due to the global shelter-in-place orders”, said Anshul Gupta, a senior research analyst at Gartner.

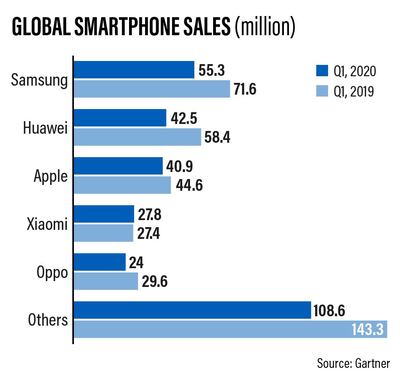

Despite its sales falling nearly 23 per cent annually in the first quarter, Samsung maintained the number one position with 18.5 per cent global market share. The South Korean company sold 55.3 million units during the period, almost 16.3 million less than last year.

The company built more inventory of products but its “inefficient online channel combined with the lockdown led to much weaker sales” Gartner said.

“Covid-19 negatively impacted Samsung’s smartphone sales during the quarter … however, the decline could have been much worse,” Mr. Gupta said. “Its limited presence in China and the location of its manufacturing facilities outside of China prevented a steeper fall.”

Huawei trailed Samsung with a 14.2 per cent market share and Apple retaining 13.7 per cent.

Shenzhen-headquartered Huawei recorded the worst performance among the top five global smartphone vendors. Its sales fell to 42.5 million units, a decline of 27.3 per cent year-on-year.

With US restrictions in place, Gartner analysts predict a challenging 2020 for the firm. Though the company has developed the Huawei Mobile Service ecosystem, it is unlikely to attract new smartphone buyers in international markets due to the absence of popular Google apps.

While Apple is not as dependent on China as other brands such as Huawei and Oppo, it faced supply constraints and store closures that negatively impacted iPhone sales in the first quarter.

iPhone sales declined 8.2 per cent yearly, totalling 41 million units during the period.

“Apple had a good start to the year thanks to its new product line up that saw strong momentum globally,” said Annette Zimmermann, research vice-president at Gartner.

“Supply chain disruptions and declining consumer spending put a halt to this positive trend in February," Ms Zimmermann said.

"If Covid-19 would not have happened, the vendor would have likely seen its iPhone sales reached record level in the quarter.”

However, Apple’s strong online presence, ability to serve customers through online stores and its production returning to near normal levels at the end of March helped it to gain some of the lost momentum, according to Gartner.

All top five smartphone manufacturers suffered a decline in shipments, except for the Chinese brand Xiaomi that grew 1.4 per cent.

Strong sales of its Redmi devices in international markets and aggressive focus on online channels led Xiaomi to achieve better than expected sales, according to Gartner.

The wider availability of affordable 5G phones was meant to cut the replacement period in 2020, but this is no longer the case.

“The delayed delivery of some 5G flagship phones is an ongoing issue,” said Ms Zimmermann.