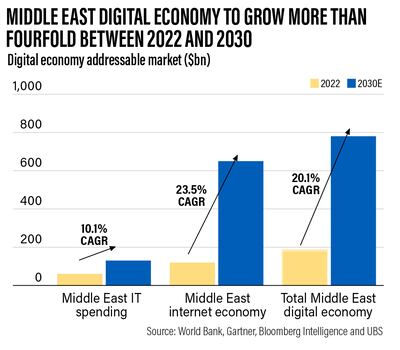

The Middle East's digital economy is projected to grow more than four fold to about $780 billion by 2030, which would significantly outpace the global average through the end of the decade, a new study has shown.

The spike from an estimated $180 billion in 2022 means the digital economy would grow at a compound annual growth rate of more than 20 per cent through the decade, Swiss bank UBS said in a new report.

That positions the Middle East to outperform the global average: the worldwide digital economy posted revenue of about $10.5 trillion in 2022 and it is projected to grow to about $23.2 trillion by 2030, which is a CAGR of 10.4 per cent – about half of the region's forecasted growth rate, the Zurich-based lender said.

By 2030, the value of the Middle East's digital economy would be equivalent to about 13.4 per cent of its gross domestic product, from more than 4 per cent last year. That trails advanced economies like the US, where the sector accounts for about 15 per cent of GDP.

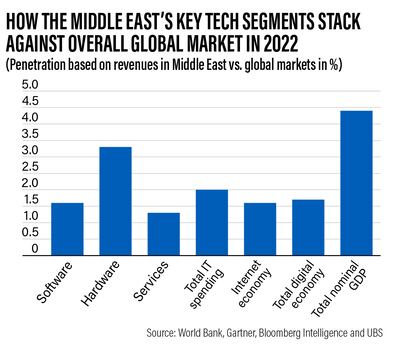

While the region is still “at a very early stage of the digital ascent” compared to the global digital economy, it has benefitted from the significant investments made during and after the Covid-19 pandemic, making it “one of the fastest-growing digital economies globally”, analysts at UBS wrote in the report.

They also argue that the Middle East is at a point where China was 10 to 15 years ago and India five to 10 years ago when the digital inflection began in those countries.

UBS divides the digital economy into two pillars: traditional IT spending, which comprises spending by both consumers and enterprises on hardware, software and services; and internet economy spending, which includes e-commerce, digital advertising, online gaming, streaming, ride-hailing, FinTech and others.

“Supported by favourable demographics, strong policy support, solid funding, rising innovation and low penetration rates, we expect the Middle East’s digital economy to grow,” UBS said.

Low penetration rates, in particular, highlight the solid long-term growth potential of the region's digital economy, including in high-margin segments like software, and the internet and its associated services, it said.

Enterprises and governments have lauded digital transformation's critical role in the economy and society as the world prepares for a future largely powered by technology.

Spending on information and communications technology in the Middle East, plus Turkey and Africa, is projected to grow almost 4 per cent annually to surpass $234 billion in 2023, the International Data Corporation previously said.

Saudi Arabia and the UAE, the Arab world's two biggest economies, will likely spend $34.6 billion and $20 billion, respectively, to be among the leaders in the region's digital economic transformation, the US research firm said.

Investor interest is also projected to grow “sharply” for the rest of the decade, with UBS analysts highlighting the software, internet and data centres as segments investors should concentrate on.

“There are two ways to participate in the Middle East’s rapidly growing digital economy – investing in the right industries or in the right companies,” they said.

“For industries, we recommend investors to consider those that can grow faster and also can generate higher margins.”

Software, in particular, is projected to carry potential with an estimated 15 per cent CAGR over the decade, UBS said, noting that software operating margins can go as high as 35 per cent to 40 per cent, which would drive strong profit growth.

“We believe software is the best way to participate in the region’s continuing digital transformation, where we expect many traditional enterprises to upgrade their IT infrastructure by driving significant investments across software,” it said.

These software services include tools for office productivity and collaboration, the cloud and cybersecurity, the study said – which highlights the current working from anywhere environment.

For start-ups – vital drivers of the digital economy – funding is perceived to have bottomed out, but the region's strong growth outlook is expected to attract more investments from local technology and telecom players, sovereign wealth funds and other global venture capital or private equity funds, UBS said.

Funding for all start-ups and unlisted companies in the Middle East was estimated at $13.6 billion in 2022, effectively flat from 2021, owing mainly to high interest rates, the latest data from CB Insights showed.

“But the good news is that green shoots are emerging thanks to the spiking interest around AI and hopes of a revival in key internet segments like e-commerce and digital advertising in the region,” UBS said.